W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

A proposed tariff increase on goods imported from China was delayed from October 1st to October 15th. Tariffs on a number of Chinese goods are scheduled to increase to 30 percent from 25 percent effective on the 15th.

U.S. equity markets marked their best third quarter since 1997, recapturing gains that were lost in the final quarter of 2018. The market’s resilience has allowed stock and bond prices to elevate higher even with the headwinds of trade tensions and recessionary concerns. Meager bond yields worldwide also fueled a gravitation towards stocks as investors sought more attractive yields in the form of dividends.

Domestic bond yields rose in September, climbing back from ultra low levels reached in August. The Fed’s easing rate trend is part of a larger global movement by other central banks to lower rates internationally.

Currency markets reacted to slightly higher U.S. rates in September, sending the U.S. dollar to its strongest levels in over two years. Various factors such as consistent consumer demand and a stable economic environment, relative to other global economies, helped drive the demand for the dollar.

A key inflation indicator, the Consumer Price Index (CPI), moved higher with its fastest annualized growth since 2008. The CPI index, which measures the price of various goods and services such as food, housing, and medical expenses, rose 2.4% over the past year. Medical insurance and healthcare related expenses saw some of the largest increases. (Sources: Commerce Depart., U.S. Treasury, BLS)

U.S. Recessions – Historical Note

Historians and economists claim that there have been 47 recessions in the United States dating back to the Articles of Confederation, which was ratified in 1781. The duration and intensity of each recession has been unique, with various factors affecting economic conditions contingent on current circumstances.

Ironically, the recession during the early 80s from 1980 through 1982 was driven by inflation and rising interest rates creating an expensive and restrictive environment for consumers and businesses. Conversely, economists currently view any probable recession driven by an ultra-low rate environment and minimal inflation, believed to be a result of excessive stimulus created by the Federal Reserve and dismal economic growth projections.

Modern recessions occurring in the 19th century have resulted from financial crises and market driven events, while recessions that occurred in the 1800s were primarily driven by war and the weather due to the dependence on agriculture. Talk of an upcoming recession in the news has been a focal discussion as low rates and weakening economic indicators create an argument for a recessionary environment. Economists and analysts see recessions as an economic cycle driven by expansions and contractions.

Sources: Federal Reserve; fred.stlouisfed.org/series/JHDUSRGDPBR

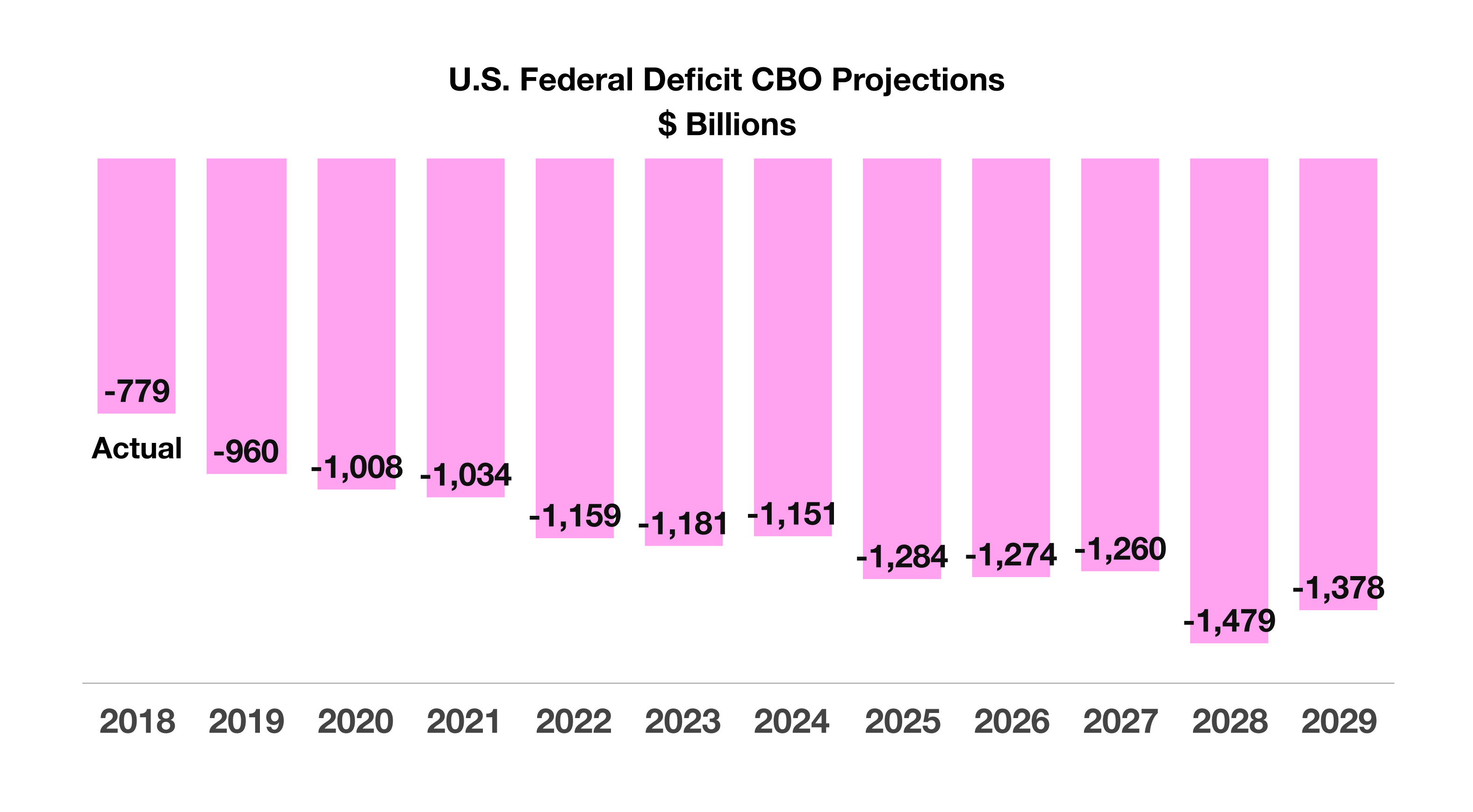

Projections over the next 10 years show an average annual budget deficit of $1.2 trillion between 2019 and 2029. The estimate represents a deficit of 4.4% to 4.8% of GDP, above the 50-year average. Even though tax revenues are estimated to grow, GDP is expected to expand at a more conservative pace. Current estimates show GDP growing at 2.3% in 2019, yet the CBO projects an average annual GDP growth rate of 1.8% over the next 10 years.

Projections over the next 10 years show an average annual budget deficit of $1.2 trillion between 2019 and 2029. The estimate represents a deficit of 4.4% to 4.8% of GDP, above the 50-year average. Even though tax revenues are estimated to grow, GDP is expected to expand at a more conservative pace. Current estimates show GDP growing at 2.3% in 2019, yet the CBO projects an average annual GDP growth rate of 1.8% over the next 10 years.