Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Worries regarding a second wave of infections heading into the fall, election uncertainties, and wavering economic indicators contributed to a dubious September.

Equities paused from their upward trajectory in September, with technology stocks repelling from their highs. Uncertainty surrounding vaccine deployment and the election are expected to influence market momentum and investor confidence. Election results will help determine the direction of fiscal policy and social program funding.

A growing number of pharmaceutical companies, universities, and biotech firms are introducing and testing various forms of vaccines to combat COVID-19. According to the Regulatory Affairs Professional Society (RAPS), there are currently over 40 COVID-19 vaccines in trial phases worldwide.

California became the first state to require that all new autos sold be zero-emission by 2035. The executive order issued by the state’s governor is expected to reverberate throughout the country, possibly leading other states to follow suit.

The Centers for Disease Control and Prevention (CDC) issued detailed guidance for this Halloween season. Among them, not to substitute a costume mask for a cloth mask, not to attend crowded costume parties, avoid visiting indoor haunted houses, and refrain from traditional door to door trick-or-treating.

With some schools resuming across the country, the CDC reported that COVID-19 cases in 19 year olds and younger have risen three-fold since May. The large increase may suggest that younger people may play an increasingly important role in community transmission, even if their risk of serious illness is low relative to the older population. The threat of a second wave of infections brought about by COVID-19 are reminiscent of the fall of 1918, when the second wave of the Spanish flu pandemic was more severe than the first.

Comments by Fed Chairman Jerome Powell indicated that additional aid to small businesses and unemployed individuals was critical for economic expansion during the pandemic. The Fed Chair urged for the passage of a second stimulus package, which has been delayed due to a Congressional impasse.

Banks and finance companies have been imposing more stringent standards for consumer and business borrowers, as noted by the Fed’s Senior Loan Officer Survey. The survey identified reductions in credit card limits, as well as tougher qualifications for auto and home loans. (Sources: www.cdc.gov/coronavirus/2019/html#halloween, CDC, Federal Reserve, World Bank, www.gov.ca.gov/2020/09/23/governor-newsom)

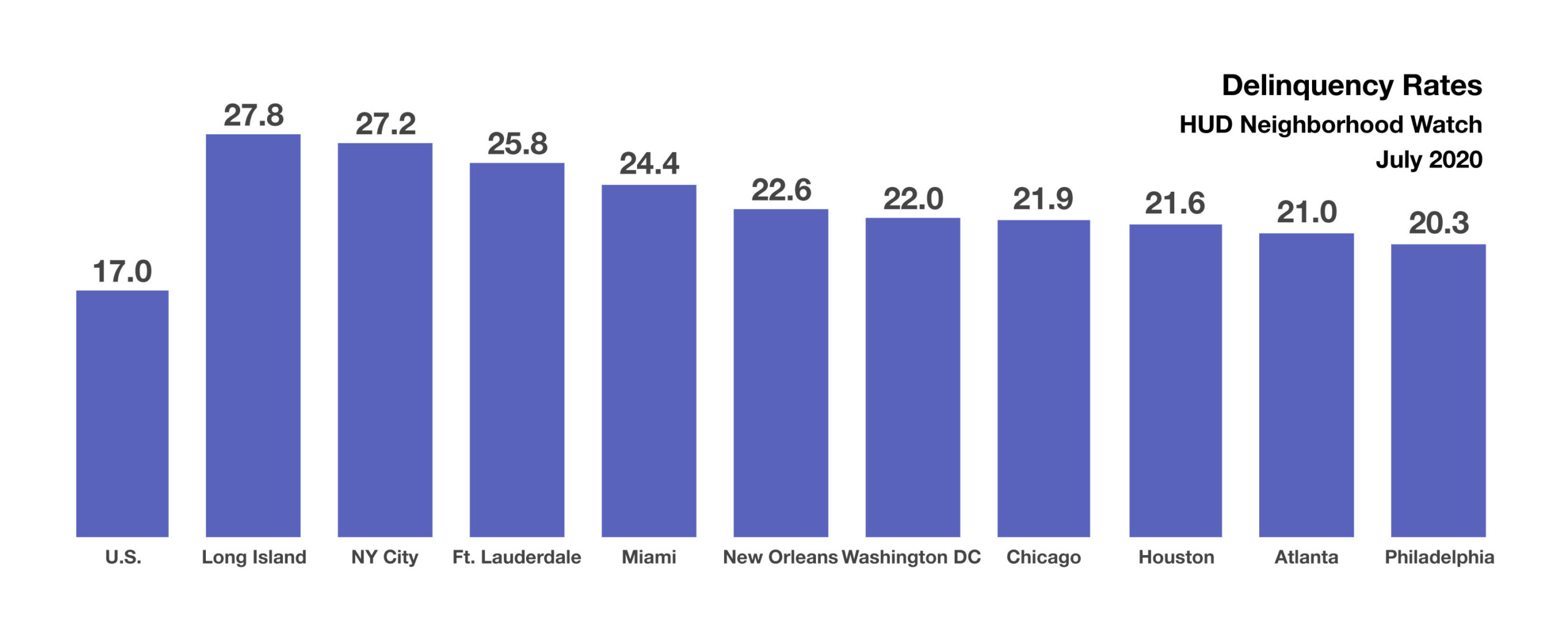

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.