W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Equities Taper Off In September – Domestic Equity Overview – Despite a pullback in September, equities managed to end the third quarter with gains. The technology sector was the primary contributor to the S&P 500 Index, which was up 8.93% for the third quarter. Consumer discretionary and industrial stocks also performed well during the quarter, exemplifying some economic recovery characteristics. Following an upward surge during this summer, September witnessed a tapering of equity momentum, leading to lower valuations. The three major equity indices, Dow Jones Industrial, S&P 500 Index, and the Nasdaq were off in September, but positive for the third quarter ending September 30th. (Sources: S&P, Bloomberg, Dow Jones, Nasdaq)

Rates Vacillate As Stimulus Efforts Unresolved – Fixed Income Overview – The Federal Reserve continues to purchase $120 billion of Treasury and mortgage agency bonds each month, expanding its balance sheet to over $7 trillion as of the end of September. The monumental buying is meant to facilitate bond market activity while maintaining a relatively low-rate environment. Yields on government and corporate bonds vacillated in September as uncertainty surrounding additional stimulus efforts influenced rates. Analysts and economists expect higher long-term rates to result from the incremental debt issuance to pay for the next stimulus package. (Sources: U.S. Treasury, Federal Reserve, Bloomberg)

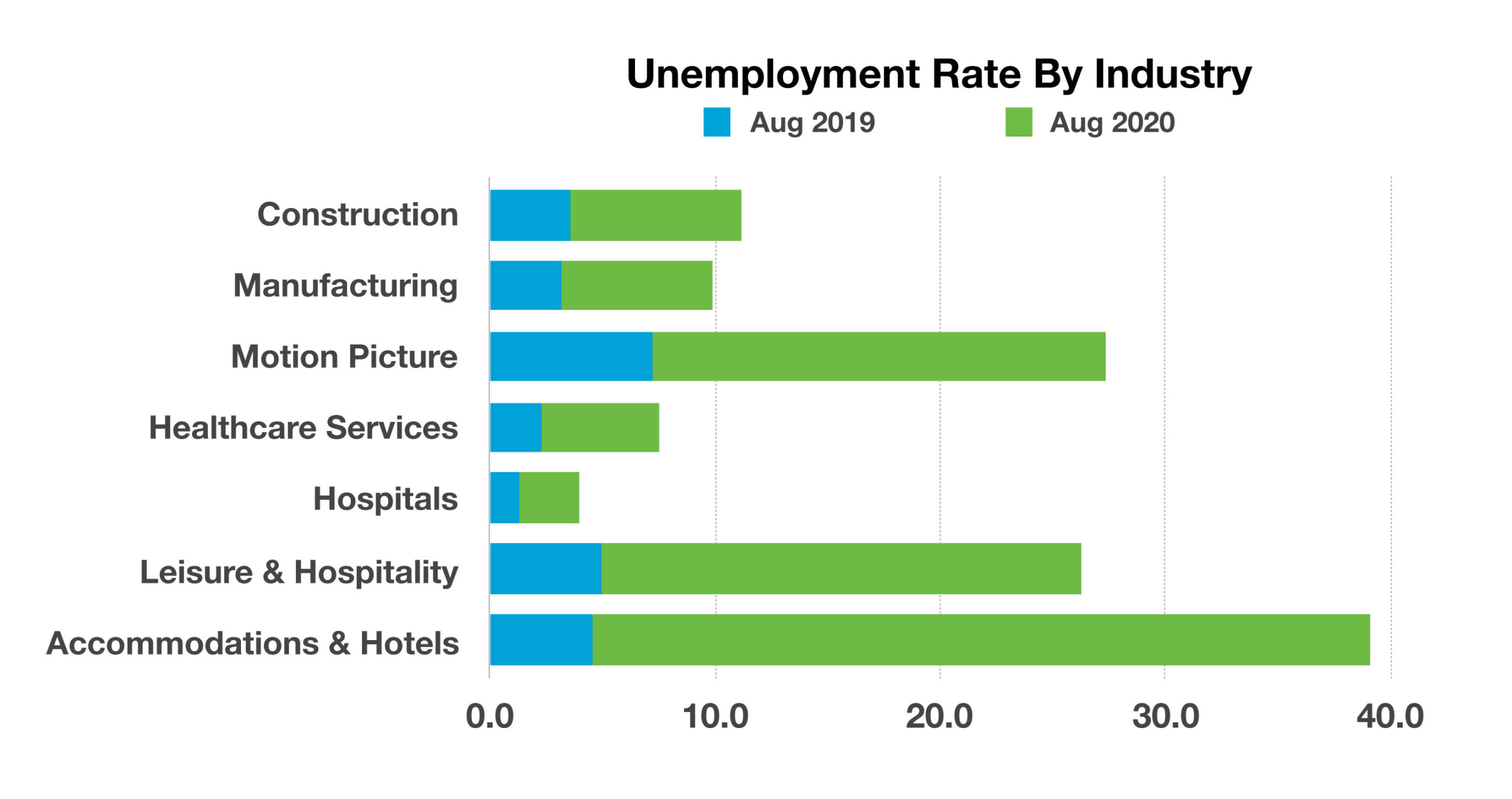

Industries That Are Experiencing Higher Unemployment Due To The Pandemic – Labor Market Overview – The most recent labor statistics made available by the U.S. Department of Labor is identifying more impactful increases in unemployment in certain industries than others. Economists and analysts believe that the year-over-year increases in unemployment are attributable to the pandemic, where mandatory closures and restrictions are continuing to hinder businesses and workers nationwide.

Unemployment is affecting various occupations differently, as the impact of the pandemic displaces certain workers more than others. Economists believe that the disparity enhances the negative affects on lower-income workers versus higher earnings, creating even more inequality among the nation’s workforce. Industries such as construction, motion pictures, hotel & leisure, and restaurants saw the most dramatic increases in unemployment relative to a year prior. Hospitals and health services saw the least amount of increases in unemployment, showing resistance to the current pandemic environment.

Source: U.S. Department of Labor

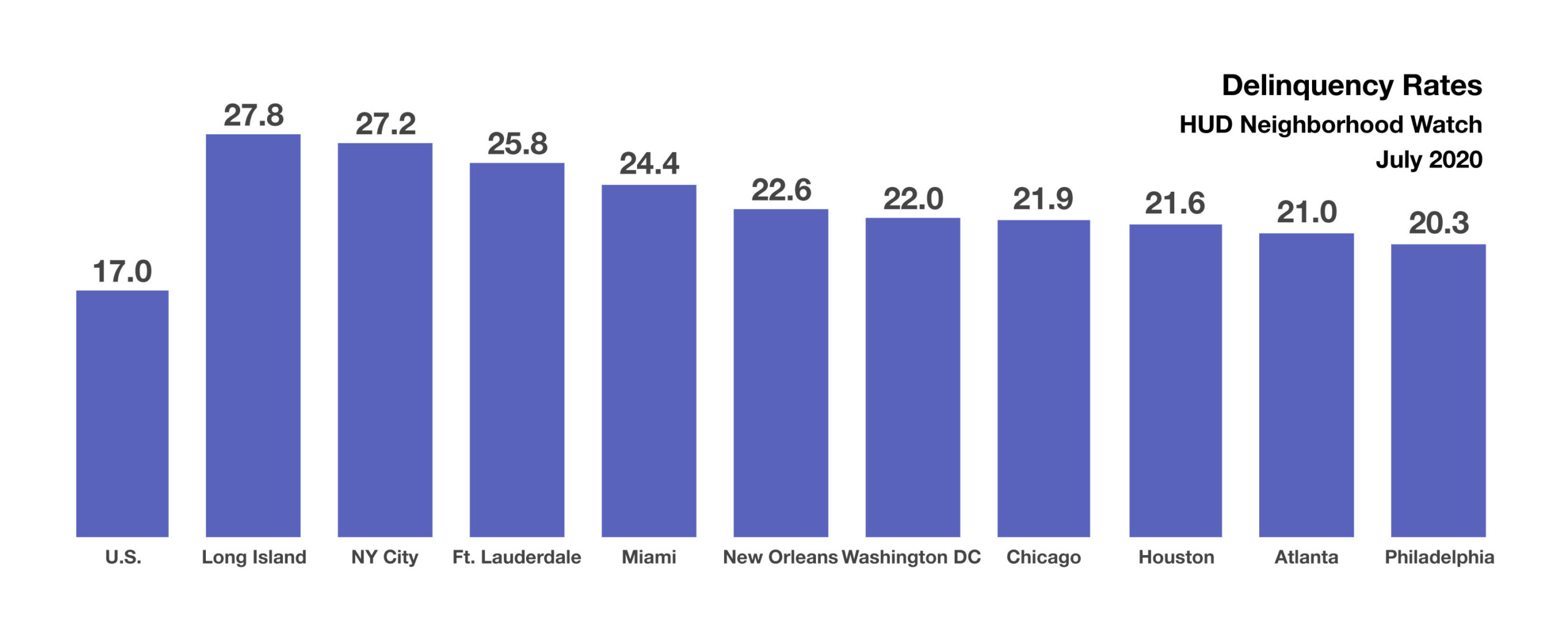

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.