Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Worries regarding a second wave of infections heading into the fall, election uncertainties, and wavering economic indicators contributed to a dubious September.

Equities paused from their upward trajectory in September, with technology stocks repelling from their highs. Uncertainty surrounding vaccine deployment and the election are expected to influence market momentum and investor confidence. Election results will help determine the direction of fiscal policy and social program funding.

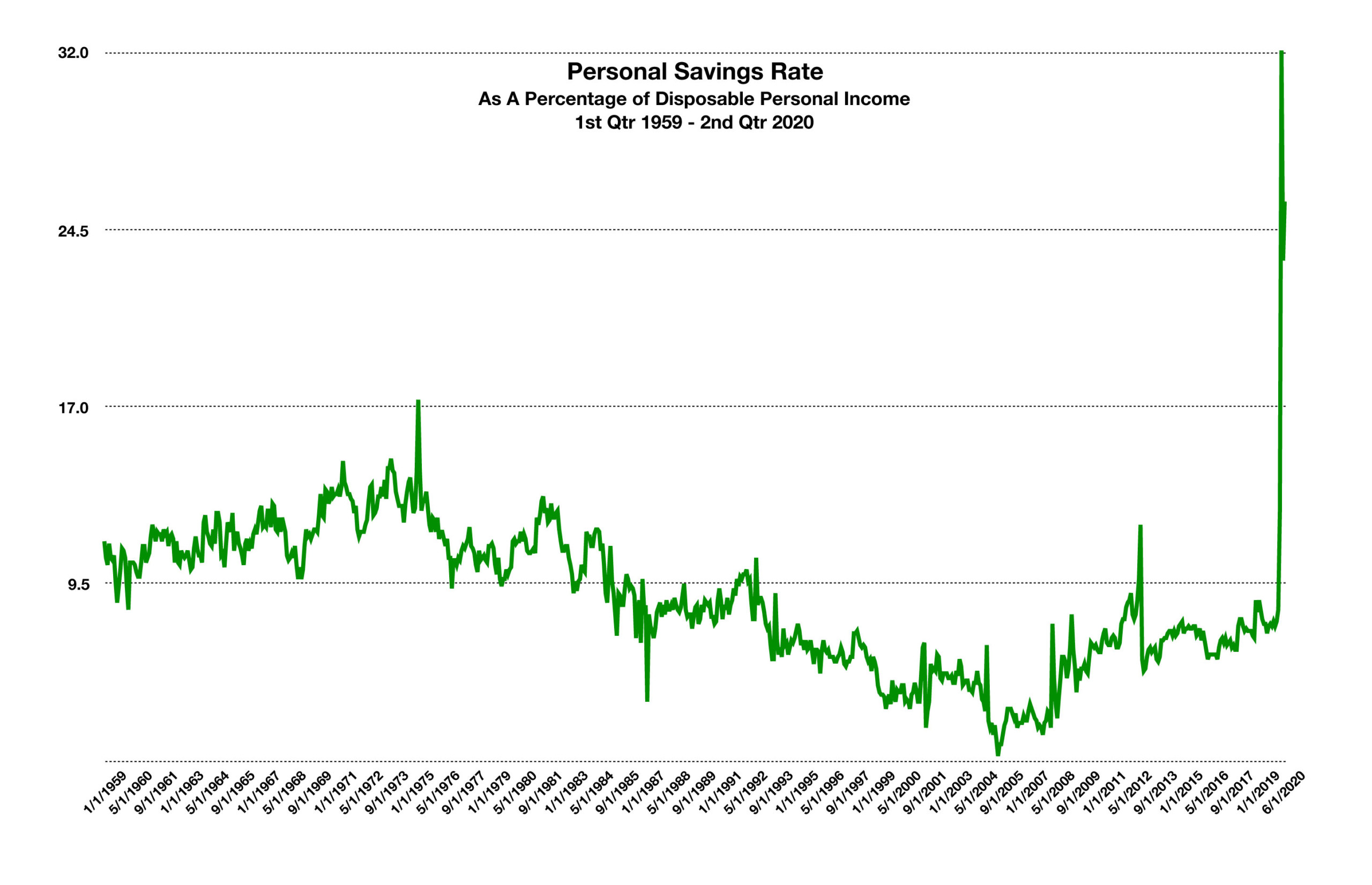

The Federal Reserve is expected to leave short-term rates near zero for up to five years in order to allow inflation to expand modestly throughout the economy. The Fed believes that inflation will be muted until economic activity picks up again as the effects of the pandemic reside.

The U.S. dollar fell to a two-year low against other global currencies, as expanding government debt issuance and uncertainty surrounding the coronavirus weighed on the currency. Credit rating agency Fitch revised its outlook on U.S. government debt from stable to negative, citing ongoing deterioration with public finances and the absence of a credible fiscal consolidation plan. Credit reporting agency Moody’s announced that it may eventually place U.S. government debt on watch for a downgrade if newly issued debt isn’t accompanied by some sort of tax revenue increase. Fixed income analysts believe that this may drive demand for corporate bonds even higher.

A growing number of pharmaceutical companies, universities, and biotech firms are introducing and testing various forms of vaccines to combat COVID-19. According to the Regulatory Affairs Professional Society (RAPS), there are currently over 40 COVID-19 vaccines in trial phases worldwide.

Comments by Fed Chairman Jerome Powell indicated that additional aid to small businesses and unemployed individuals was critical for economic expansion during the pandemic. The Fed Chair urged for the passage of a second stimulus package, which has been delayed due to a Congressional impasse. The Paycheck Protection Program had issued 5.2 million stimulus loans totaling $525 billion as of August 8th, when the program closed. Another round of stimulus funding for businesses may be included in a new bill drafted by Congress.

Banks and finance companies have been imposing more stringent standards for consumer and business borrowers, as noted by the Fed’s Senior Loan Officer Survey. The survey identified reductions in credit card limits, as well as tougher qualifications for auto and home loans.

(Sources: www.cdc.gov/coronavirus/2020, CDC, Federal Reserve, World Bank)

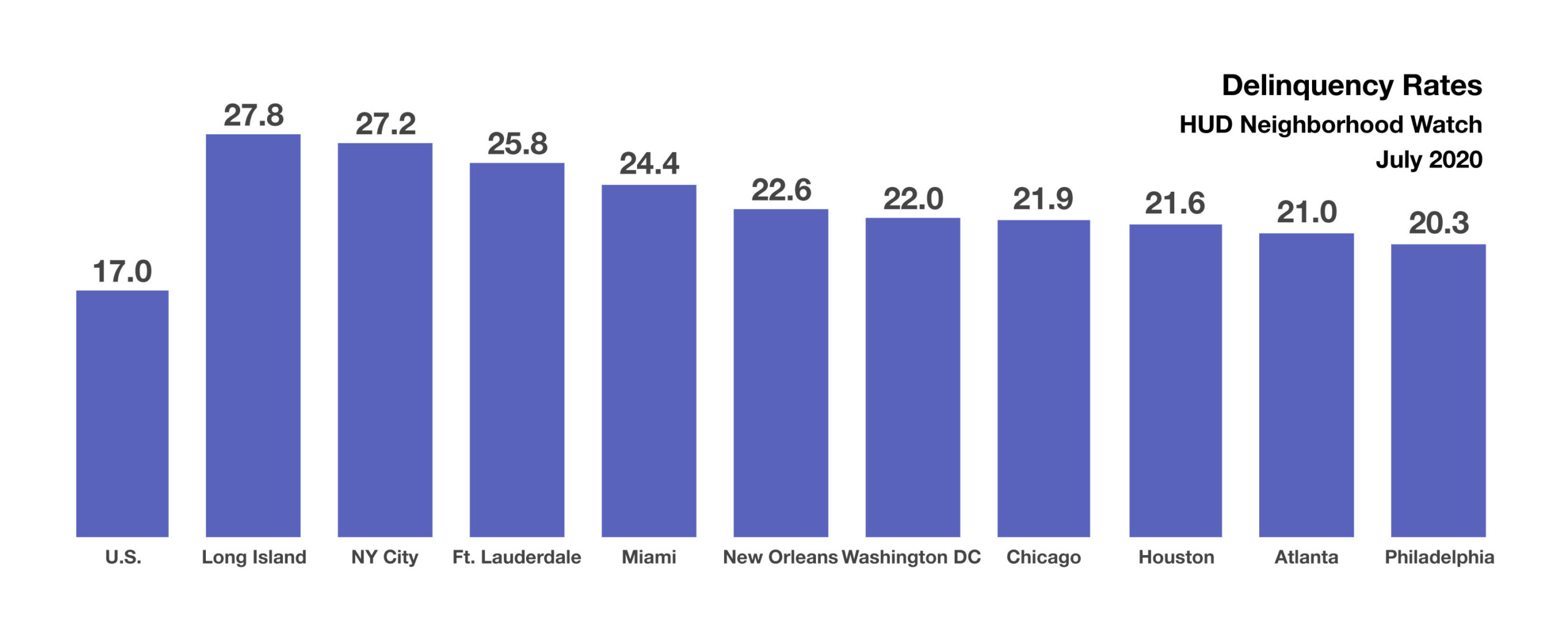

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.