Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Good morning, Valued Clients!

I held back this quarter’s newsletter because of the election. While we do not make investment choices based upon geopolitics, some things have been clarified that make me more confident to speak about the markets and the economy. While the Presidential election remains undecided for at least a couple more days, President Trump has promised to take “the process” to the US Supreme Court. This could take awhile…

One thing that looks certain based upon the market’s reaction since November 3rd. Voters appear to prefer a divided government with it’s checks and balances. Assuming the house and senate remain finally split by party, they are projecting status quo in the market.

Based upon that paradigm, it is KCG’s job to allocate to optimize opportunities and reduce risk whee possible. No big surprise…I recommend we maintain your target allocations which were built for optimal performance in the long run! A prolonged delay or contested result could cause more volatility, but historically, stocks have performed well over most time periods, regardless of which party controls the White House and Congress. KCG’s focus is on the long-term investment horizon with a disciplined investment approach and diversification. Besides, increased market volatility often provides us an opportunity to purchase attractive investments at lower prices.

That being said, one concern we have for taxable accounts is the potential change in capital gains in 2021. Even if we aren’t absolutely sure who is President by December 31st, I recommend taking as many capital gains as possible in 2020, without forcing yourself into the next marginal tax bracket. This will likely require a call to your CPA, but it will be worth it! Consider the potential loss going forward, of another 20% of the value of your gains. Really… calculate the math!

Also, with the possibility of a Biden administration on the horizon, the need to engage in meaningful estate tax planning is once again upon us. The estate tax exemption is rumored to be lowered to $5 million, down from $11 million. It has even been rumored in the past, that the step up in capital gains and the estate tax exemption could be eliminated altogether. I don’t know if that might really happen, but with the amount of debt that the Modern Monetary Policy (just printing more money) has created, don’t expect this to be the end of the story. Either party will need to raise taxes eventually, and probably sooner rather than later.

Regardless of whether your candidate wins or loses,

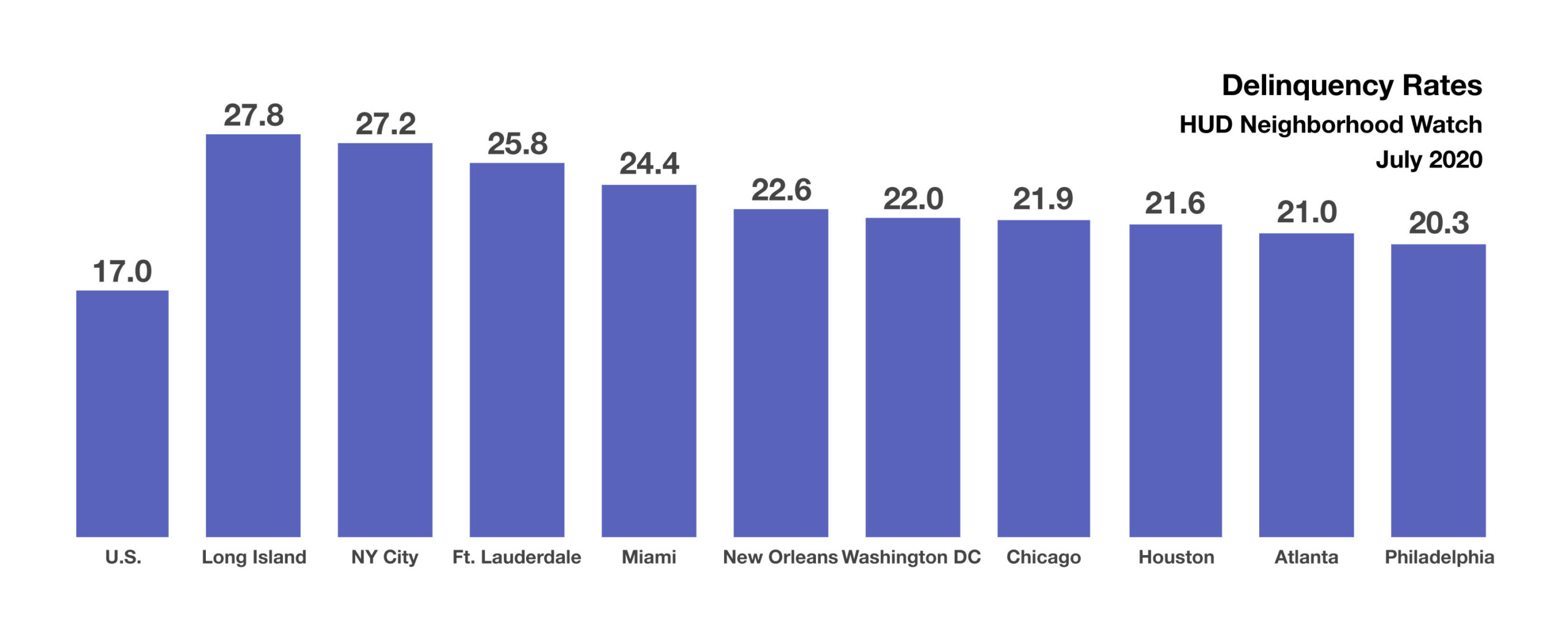

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.

According to the Mortgage Bankers Association, roughly 3.5 million home loans were in forbearance as of September 6th, representing 7.01% of all FHA-insured loans. In addition to homeowners in forbearance, there are those homeowners that are delinquent on the loans. It is expected that millions of homeowners on forbearance will become delinquent on those loans by the end of 2020, including many who have not made a payment since March of this year. Another government housing entity, the U.S. Department of Housing and Urban Development (HUD) tracks loans in delinquency via its Neighborhood Watch list. The data reported that 17% of all FHA-insured loans were delinquent in July of this year. The figure includes mortgages in forbearance as well as those not in forbearance.