Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

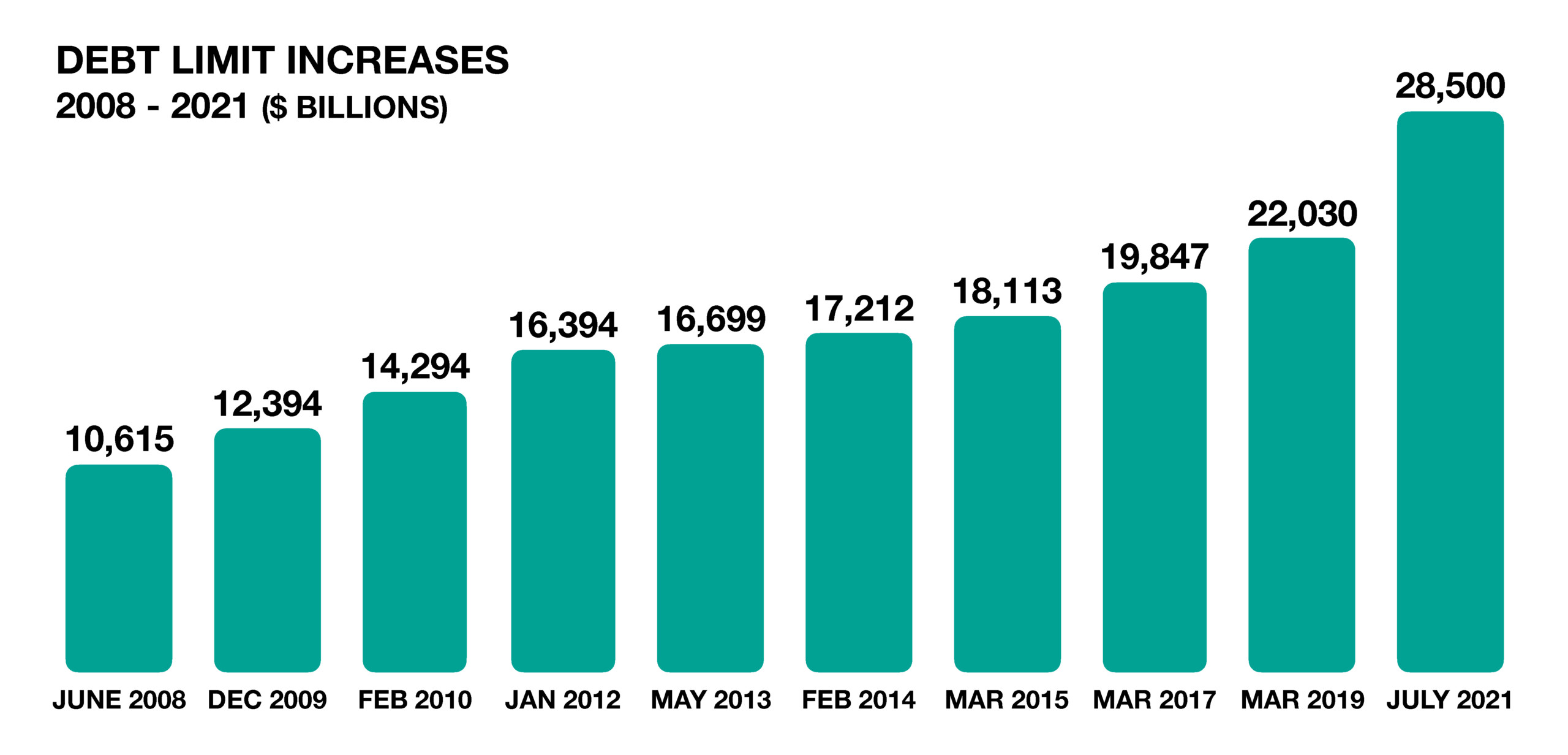

A Congressional standoff regarding an increase to the national debt limit led to market volatility in September and early October. Impasses regarding the debt ceiling have occurred numerous times since the limit was established in 1917.

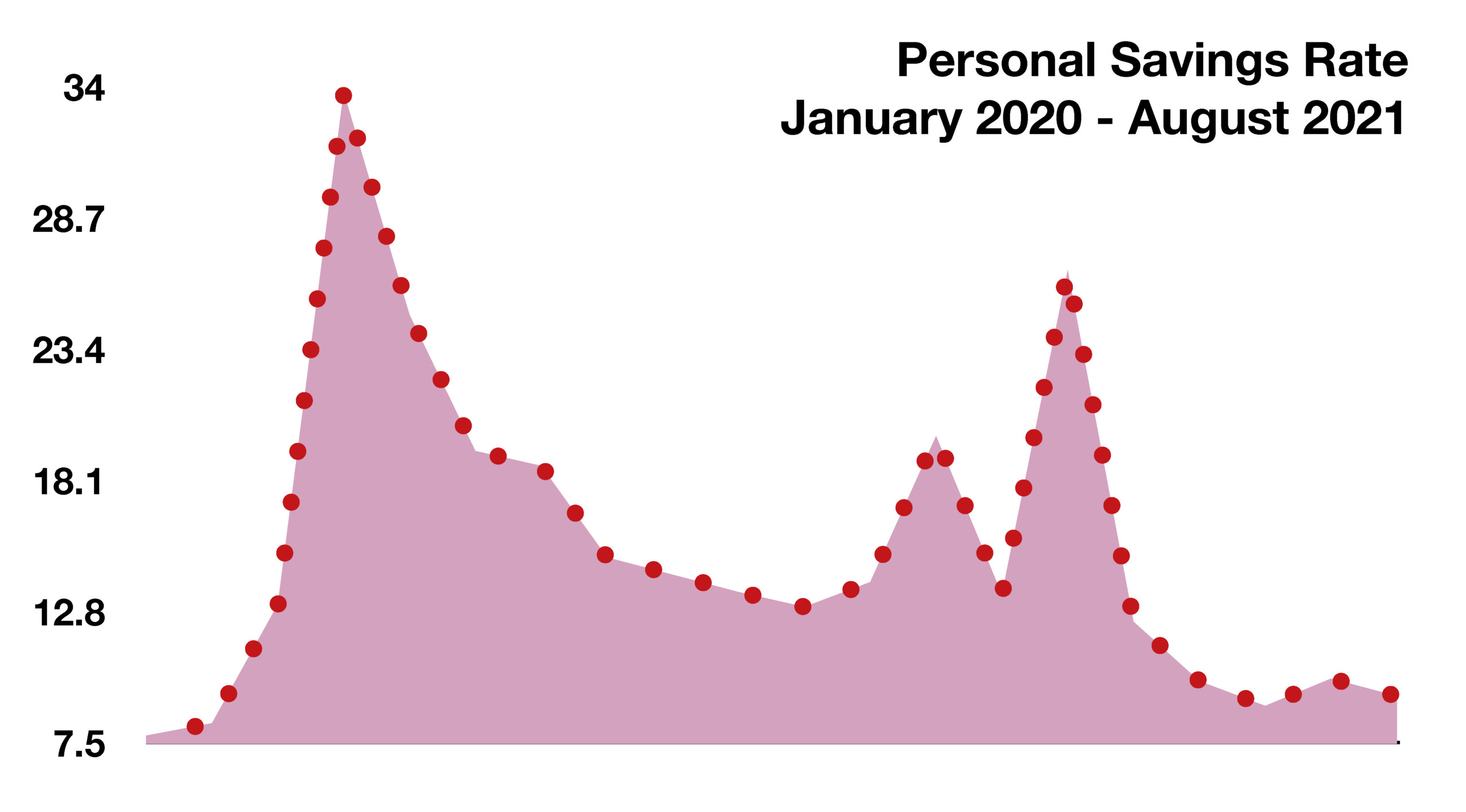

Some economists believe that cessation of stimulus payments and growing inflationary pressures may hinder economic expansion heading into 2022. Adding to consumer tensions are proposed legislative tax reform measures that create uncertainty regarding tax and estate planning. Among the proposals are increased capital gains taxes, reductions in estate tax exemptions, and limits on transferring assets to heirs with favorable tax treatments.

The number of deaths officially attributed to COVID-19 in the U.S. has now surpassed the number of fatalities from the 1918 flu pandemic. The CDC reported that over 675,000 people have died thus far, equaling those who died in the 1918 pandemic. Notably different is the fact that the population of the U.S. has nearly tripled since 1918, meaning that the relative toll in terms of total population is still lower.

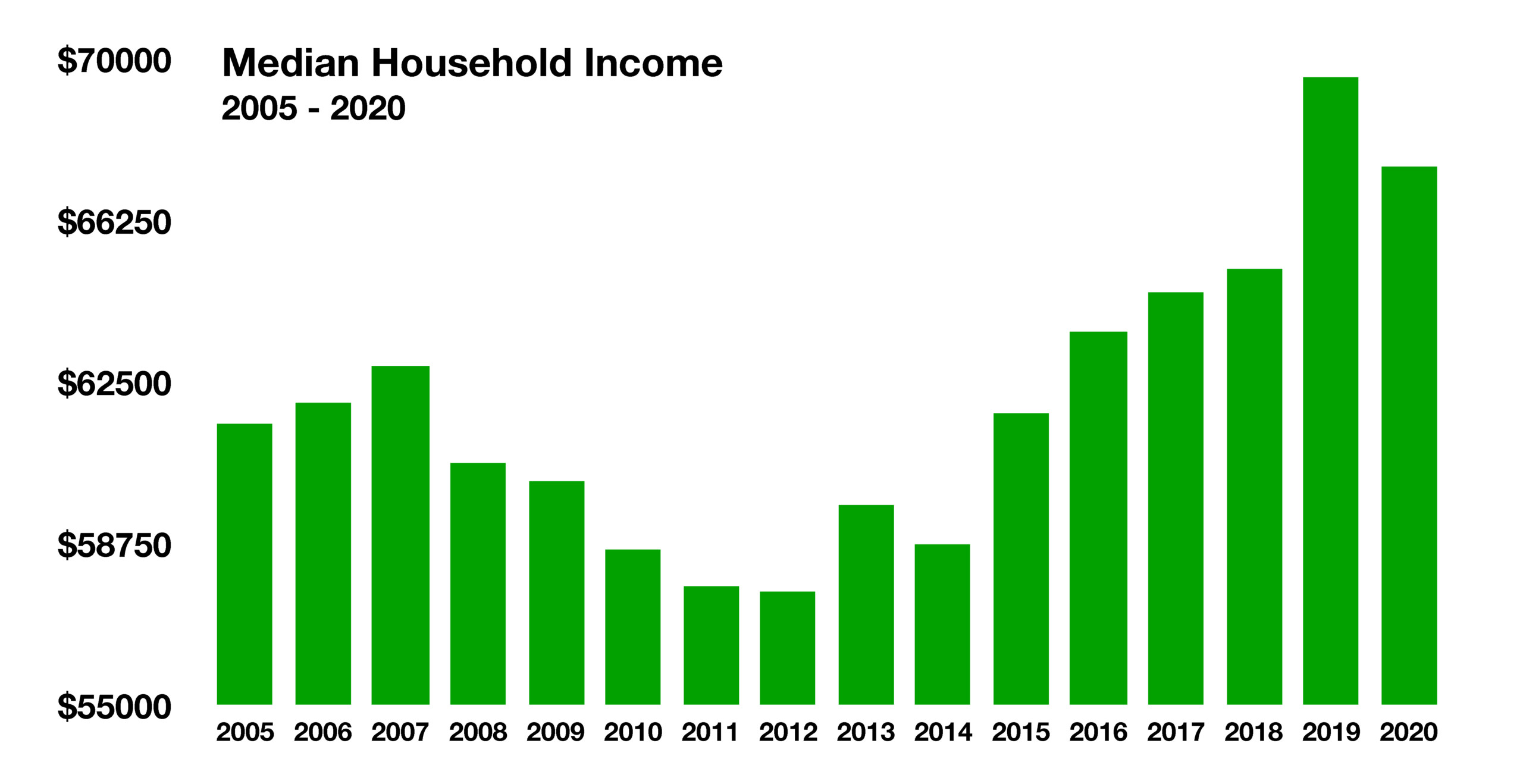

Economists note that wage gains have been trailing price gains throughout the economy, meaning that consumers are able to buy less. Housing rental costs, the largest expenditure for many consumers, are expected to increase as forecast by the Federal Reserve Bank of Dallas. Interest rates rose in September driven by inflationary influences and the Federal Reserve’s signal that it will start to taper stimulus support by the end of the year. Heightened energy prices and ongoing supply constraints are stoking inflationary concerns as consumers resume spending on products and services. Gasoline, oil, and natural gas prices rose in September as supply constraints and increased global demand contributed to price pressures.

The month of September saw two significant opposing positions for digital currency as El Salvador became the first country to adopt a cryptocurrency as its legal tender and China’s Central Bank declared all crypto-related transactions illegal, citing concerns about gambling, fraud and money laundering. (Sources: CDC, U.S. Treasury, Federal Reserve)