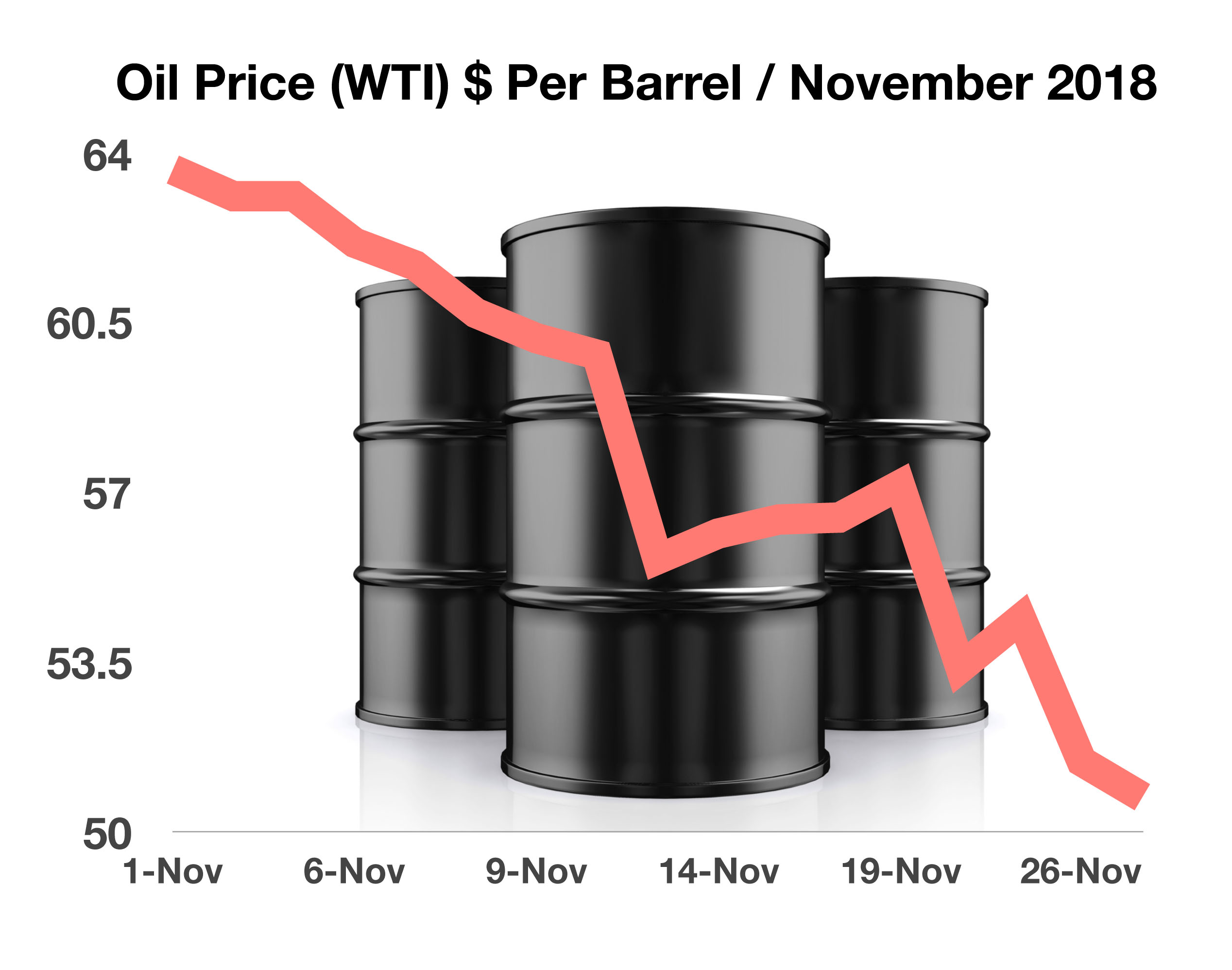

Oil Prices Take A Large Drop – Commodities Update

Global oil prices declined sharply in November, with the domestic benchmark (WTI) falling 22% for the month, the single largest monthly drop in 10 years. The steep drop in price is a result of increased production by U.S. producers as well as Saudi Arabia, Russia, and OPEC.

The recent price decline is of grave concern to OPEC, Russia, and Saudi Arabia, whose breakeven cost for oil production is estimated to be higher than U.S. production. The rapid expansion of supply in the U.S. has resulted in large amounts of unrefined oil in storage, which must then reach refineries for the final transformation into gasoline. Construction of new pipelines and transportation infrastructure in the U.S. will facilitate the shipment of crude oil much more rapidly and efficiently over the next few years.

Adding to oil’s pressure is the strong dollar, which lowers oil prices internationally since oil is primarily traded in U.S. dollars worldwide. Sanctions on Iranian oil exports were not as rigid as planned, continuing to allow millions of additional barrels to flood world markets.

The United States is currently exporting more oil than it is importing, which helps insulate the country from global price swings and adds leverage for U.S. producers competing with foreign producers. U.S. exports of crude oil and petroleum products have more than doubled since 2010 according to the Department of Energy.

Sources: Department of Energy, IEA