Scott Coffee

Registered Representative

10205 Westheimer, Suite 500

Houston Tx, 77042

832.866.9476

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

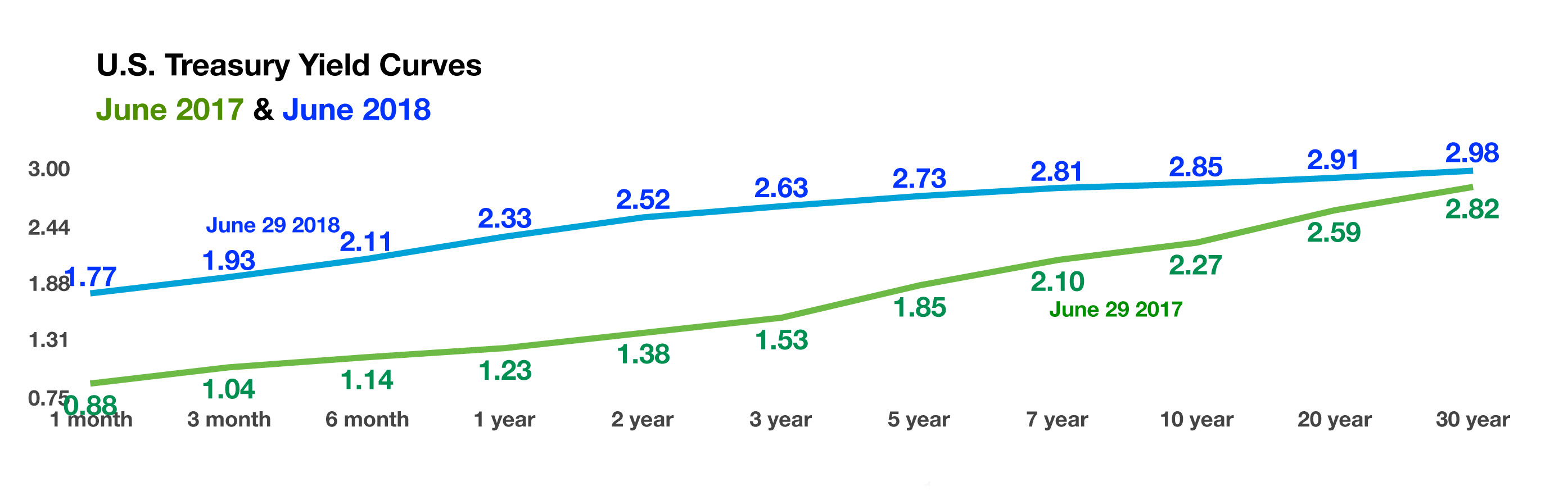

- Overview – July 2018 Trade and tariffs disrupted markets in June as the U.S. Commerce Department announced tariffs on $250 billion worth of Chinese imports. The 25% tariffs will be imposed on 1,300 items encompassing a variety of products including aluminum, iron, gas turbines, snow blowers, milking machines, and dental drills.A flattening yield curve, characteristic of rising short-term rates along with lingering long-term rates, startled fixed income markets. Higher interest rates reflect expectations of inflationary pressures and robust growth, while lower rates imply less inflation and dismal economic expansion.

- The Fed is accelerating the rate of tightening with increases slated for 2019 and 2020 now expected to occur in 2018 and 2019.

- costs, and a tight labor market are contributing to consumer inflation. The Atlanta Federal Reserve’s economic growth model, now, estimates GDP growth for the second quarter of 2018 at 4.5%, adding to inflationary pressures.

Reports from various Federal Reserve district banks reveal that a robust economy, growing tariff pressures, rising wage

Household wealth reached $100 trillion for the first time ever, as reported by the Fed. The $100 trillion mark is double of where household wealth was at the lows of the financial crisis in 2009.

The Supreme Court ruled in June that public sector unions cannot charge fees to government employees who do not support the union and who do not want to pay. The decision is expected to further weaken the influence of unions, which have been in a decades-long decline.

Emerging market currencies faltered against the U.S. dollar as global trade tensions and rising rates in the U.S. added pressure on emerging economies. China’s stock market and currency are both off since tariff contentions began, with the Shanghai Composite Index off 13.9% for the year and the Chinese currency off 3.5% against the U.S.dollar in June alone.

Volatility in the second quarter didn’t deter equity indices, as the S&P 500 was up 2.9% and the Dow Jones was up 0.7%. The tech heavy Nasdaq advanced 6.3% for the quarter, driven by buyers seeking shelter from the imposed tariffs. A stronger U.S. dollar is starting to weigh on the technology sector as earnings may become affected.

Sources: U.S. Commerce Dept., Federal Reserve, U.S. Treasury, https://www.supremecourt.gov, Bloomberg, S&P,Dow Jones, Nasdaq Macro