Stencil Financial

28734 Rain Creek Road

Hanover, MI 81129

851.357.2257

dan@stencil.com

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Hi everyone, have a great summer!

Fixed Income

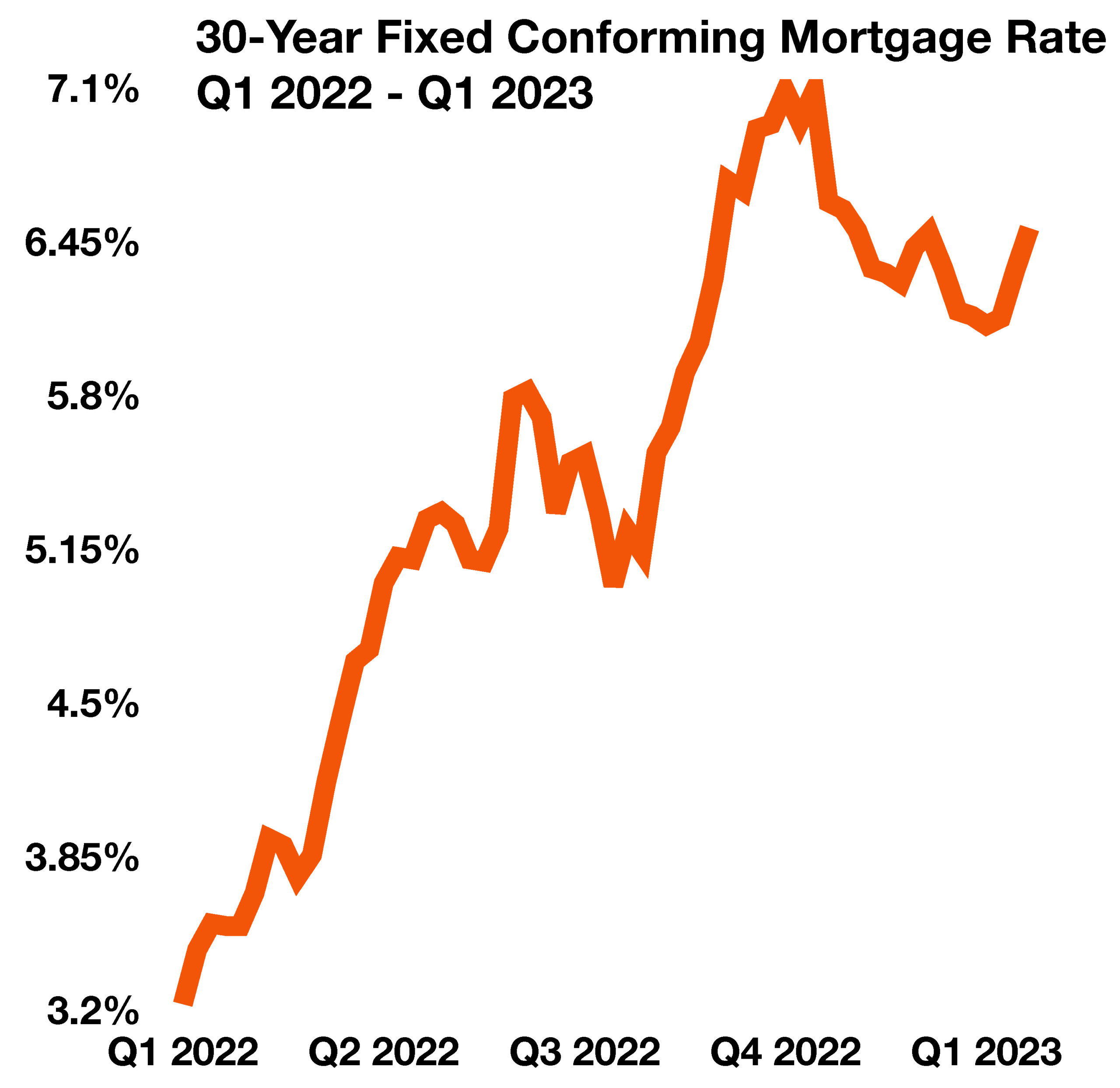

As expected, the Federal Reserve announced the execution of its final rate increase in early May. Bond markets reacted with lower long-term yields as the Fed’s next move is projected by some analysts to be a reversal of rates. Elevated shorter-term bond yields are also expected to fall should the Fed reverse course.

Long-term bond yields held steady in April, while short-term bond yields rose slightly. Analysts view this as an indication that the Fed may still raise short-term rates a bit more, yet expect inflation to ease longer term. Yields on the 10-year and 30-year Treasuries had nearly no change in April, yet yields on the 3, 4, 6, and 12-month Treasuries all saw increases.

Sources: U.S. Treasury, Bloomberg, Reuters.