Macro Overview

Markets have become data sensitive as varying economic news moved equities and bonds in anticipation of a looming Fed rate hike. Some members of the Federal Reserve are leaning towards a rate increase before the end of the year rather than waiting until next year.

Growth estimates for the economy were revised down again in August with GDP growth revised to a 1.1% annual growth rate. Even though economic data has been mixed, the Fed may consider some of the data strong enough to raise rates sooner. Some Federal Reserve watchers believe that comments made by Fed members in August were meant to shore up rates a bit without the Fed actually raising rates, a tactic used before.

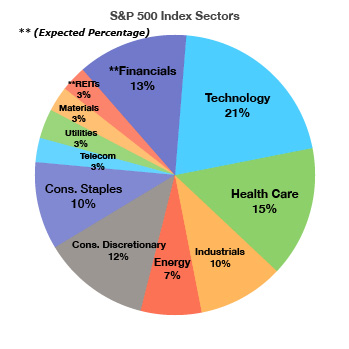

The S&P 500 index will have a new sector added in September with Real Estate Investment Trusts (REITs) comprising the 11th sector of the index. REITs have been part of the financial sector for years and have now earned their own designated category with an expected 3% allocation.

Internationally, worries still abound regarding the uncertainty of the EU’s future without Britain. Of concern is the lack of new capital investments by companies as a result of new rules that will take up to two years to formalize. Some see possible correlations between the EU vote in Europe and the U.S. presidential election in November, as polls failed to capture the voting intentions of marginalized and antiestablishment voters during the Brexit vote in Great Britain.

Volatility with oil prices continued producing reactions to headlines surrounding inventories, production, and OPEC policies. Domestic oil drillers and energy companies have been quick to acclimate to lower oil prices by retooling and curtailing production and costs. Decisions to increase production is seen as a validation that debt levels are under control and companies are positioned to expand, as long as oil prices stay around $50 per barrel.

Back to school sales rank as the second biggest shopping season for retailers, after the winter holiday season. According to the National Retail Federation (NRF), back to school shopping generates over $27 billion in retail sales every season.

Sources: FDIC, Federal Reserve, S&P, Reuters, Eurostat, NRF

age facilities, self-storage facilities, movie theaters, timber and even prisons.

age facilities, self-storage facilities, movie theaters, timber and even prisons.

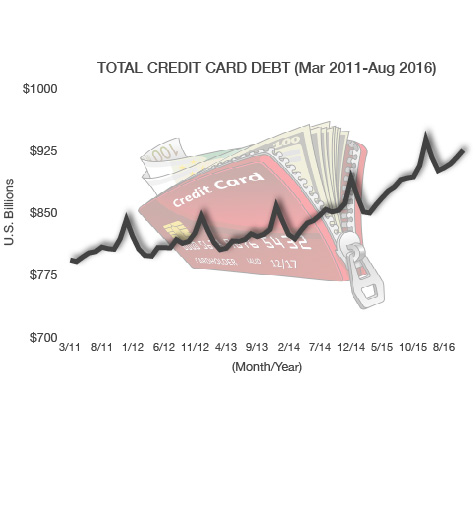

al crisis have found their credit scores improving. Bankers attribute a rise in credit card issuance to rising home prices and low unemployment. Banks are also lending more since one of the most important drivers of their profits are net interest margins, the difference between returns on assets and the cost of funds, which remain near their lowest levels in decades. The average credit limit per card for a subprime borrower is about $2,300, compared with about $11,500 for the safest customers.

al crisis have found their credit scores improving. Bankers attribute a rise in credit card issuance to rising home prices and low unemployment. Banks are also lending more since one of the most important drivers of their profits are net interest margins, the difference between returns on assets and the cost of funds, which remain near their lowest levels in decades. The average credit limit per card for a subprime borrower is about $2,300, compared with about $11,500 for the safest customers.