Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Hurricane Harvey prompted an agreement between the President and congressional leaders to increase the politically charged debt ceiling in order to help fund repair efforts in Texas. The agreement will avert a government shutdown until mid-December, providing essential funds for ongoing government operations.

On track to be one of the most costly natural disasters in U.S. history, Hurricane Harvey is expected to be a catalyst for economic expansion as the clean up and rebuilding process begins. Such an effort, as occurred in Louisiana following Katrina, will involve concrete, lumber, plumbing, and electrical components from all over the United States.

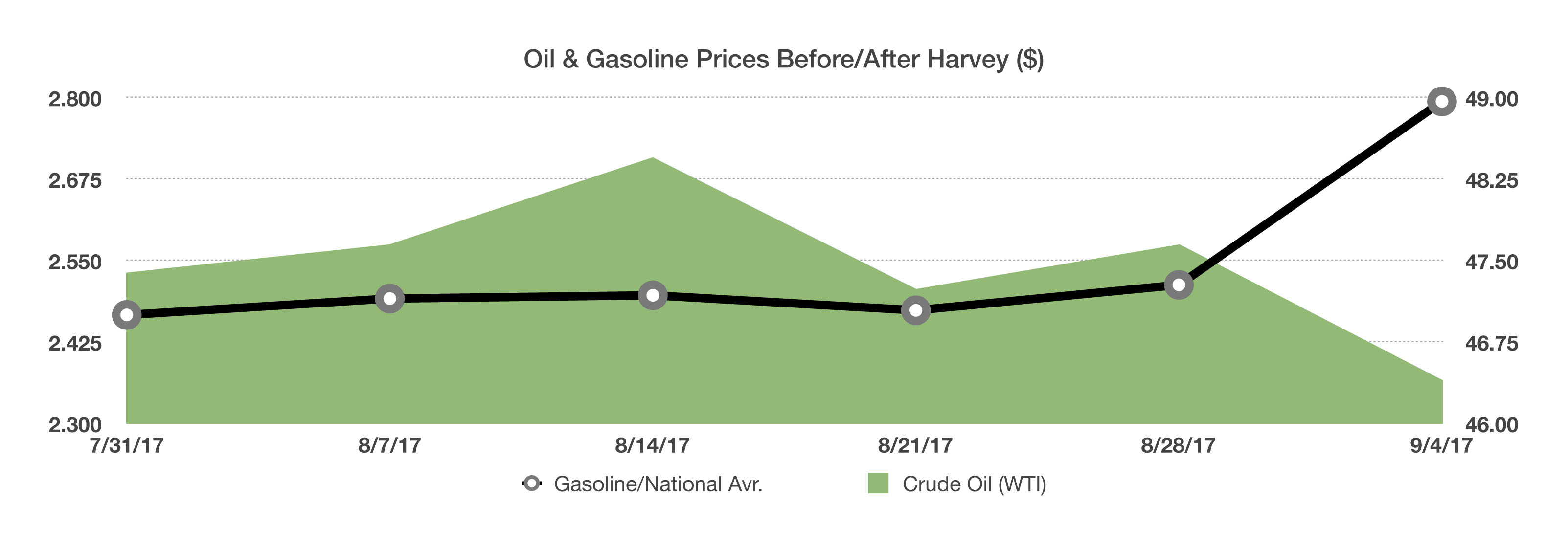

The hurricane affected and closed an estimated quarter of all U.S. refining capacity. Harvey’s impact on the price of refined crude oil products, such as gasoline and jet fuel, validates how crucial the Gulf Coast and Texas are to the global energy markets. Ever since Congress lifted the oil export ban in December 2015, almost all exports of U.S. oil are shipped from ports in Texas. Department of Energy data shows that U.S. refiners were using 96.6% of their available capacity before Hurricane Harvey hit, the highest rate since 2005.

Unemployment has fluctuated between 4.3% and 4.4% over the past three months, with the most recent data lifting the unemployment rate to 4.4%. Even with such a low unemployment rate, the growing concern among economists and analysts is that wage growth is essentially stagnant, with less than 0.1% growth in August as reported by the Labor Department. Year-over-year growth for hourly earnings has been stuck at 2.5%, which means that American workers are barely keeping ahead of the current annualized inflation rate of 2.0%.

There are several suggestions as to why wage growth has remained stagnate. Ever since the crisis of 2008/2009, companies have embraced profound cost reductions, while also grappling with demographical constraints. Downward pressure on wages has also been a result of older (baby boom) workers retiring and being replaced by younger, lower paid workers.

For the prior year, the rising costs of health care and housing accounted for roughly 40% of growth in consumer spending. The two prominent age groups affected are seniors subject to rising healthcare costs, and younger consumers that struggle to purchase a home.

It is expected that the Federal Reserve will finally decide to start paring its $4.4 trillion balance sheet of mortgage and government bonds this fall, following its two-day September policy meeting. No one truly knows how that will unravel, since it has never actually occurred to this magnitude.

Equity markets continued their resilient climb in August, with the Dow Jones Industrial Index reaching 22,000 for the first time. Geopolitical risks with North Korea helped drive government bond yields lower, as risk adverse tactics evolved. (Sources: Department of Labor, Department of Energy, Dow Jones, NOAA)

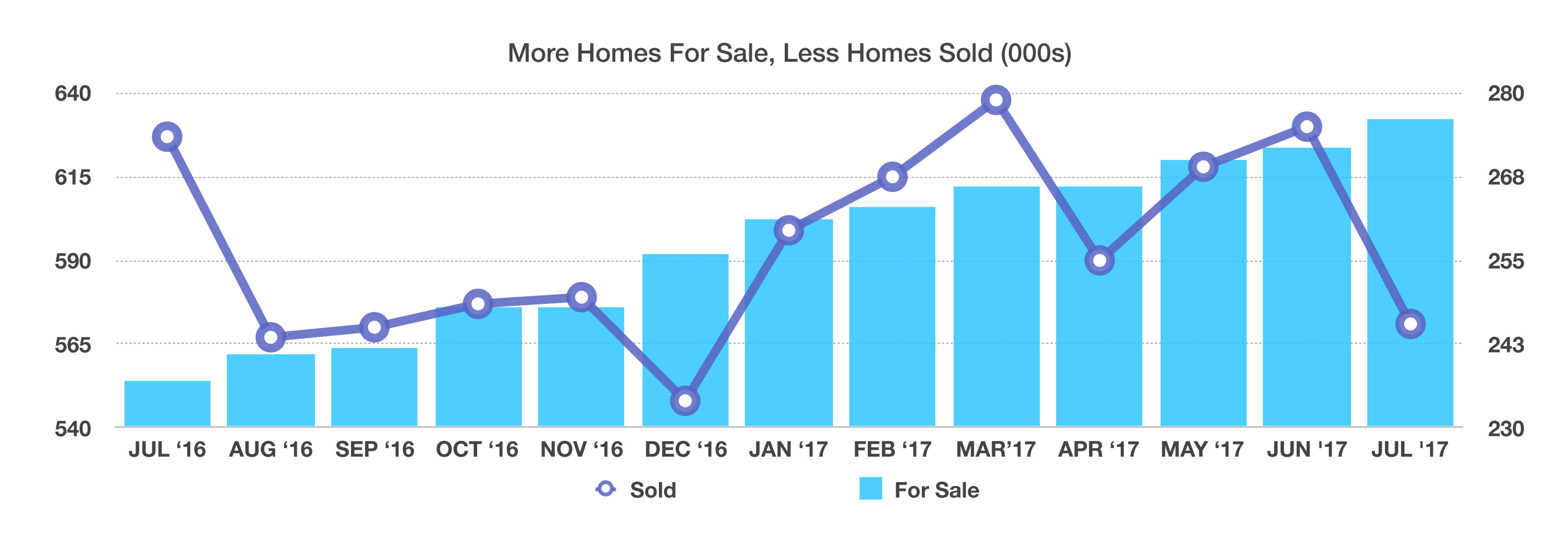

The most recent data available reveals that for the past year, as of July 2017, there was an increase in the number of homes for sale and a decrease in the number of homes sold. At the end of July, there were 276,000 homes for sale while there were 571,000 homes sold. July 2016 saw 627,000 homes sold with only 237,000 homes for sale nationwide. (Sources: U.S. Census Bureau, HUD)

The most recent data available reveals that for the past year, as of July 2017, there was an increase in the number of homes for sale and a decrease in the number of homes sold. At the end of July, there were 276,000 homes for sale while there were 571,000 homes sold. July 2016 saw 627,000 homes sold with only 237,000 homes for sale nationwide. (Sources: U.S. Census Bureau, HUD)

The dollar is down approximately 8% since the beginning of the year versus a basket of major currencies. The decline has been especially pronounced against the Mexican peso, where ongoing NAFTA negations have been a focal point. (Sources: Reuters, Bloomberg)

The dollar is down approximately 8% since the beginning of the year versus a basket of major currencies. The decline has been especially pronounced against the Mexican peso, where ongoing NAFTA negations have been a focal point. (Sources: Reuters, Bloomberg)