Doug Kinsey

Artifex Financial Group

2305 Far Hills Avenue, Suite 206

Dayton, OH 45419

855.752.6644

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Trade and tariffs continued at the forefront of discussions among the U.S. and international trading partners. Topics at hand included the North American Free Trade Agreement (NAFTA), the World Trade Organization (WTO), and protecting U.S. intellectual property rights internationally.

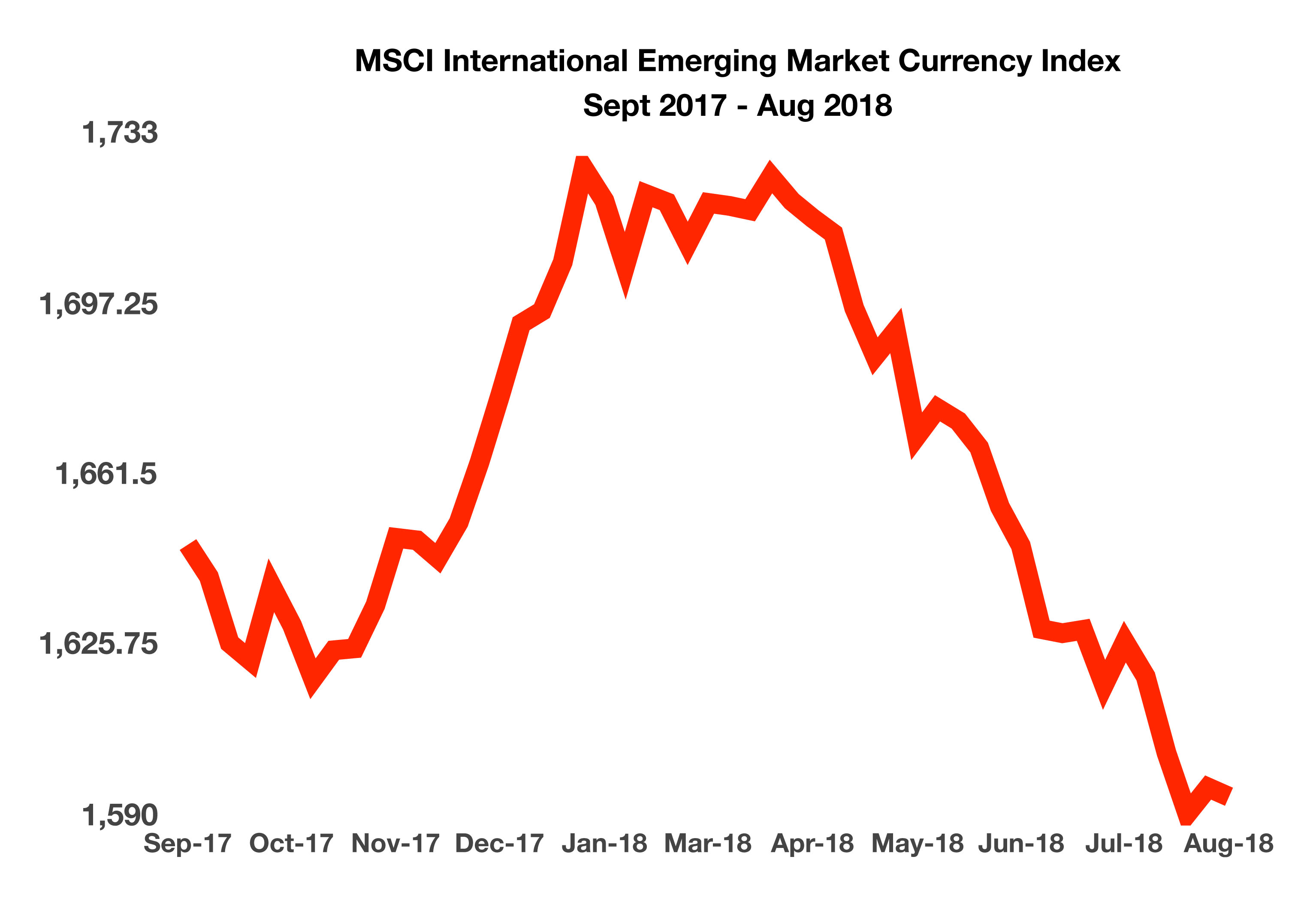

Emerging market currencies were rattled worldwide as turmoil with Argentina and Turkey spilled over into the broader markets. Contagion concerns spread in late August as Turkey’s currency fell following comments by the European Central Bank (ECB). Argentina saw its currency collapse as it sought immediate financial assistance from the International Monetary Fund (IMF). Contagion refers to the threat of what is occurring in Turkey and Argentina could migrate to other emerging market economies. The brewing financial crisis with Turkey is similar to the government debt crisis that occurred with Greece eight years ago. Recently imposed U.S. sanctions on Russia added to emerging market distress as the Russian ruble weakened versus other major currencies and the U.S. dollar.

The stock market marked its longest period of uninterrupted gains in history, running 3,453 days from the market low on March 9, 2009 during the depths of the financial crisis. Since then, the Dow Jones Industrial Index catapulted from 6,500 to over 25,500 in August, while the S&P 500 sprang from 666 to over 2800.

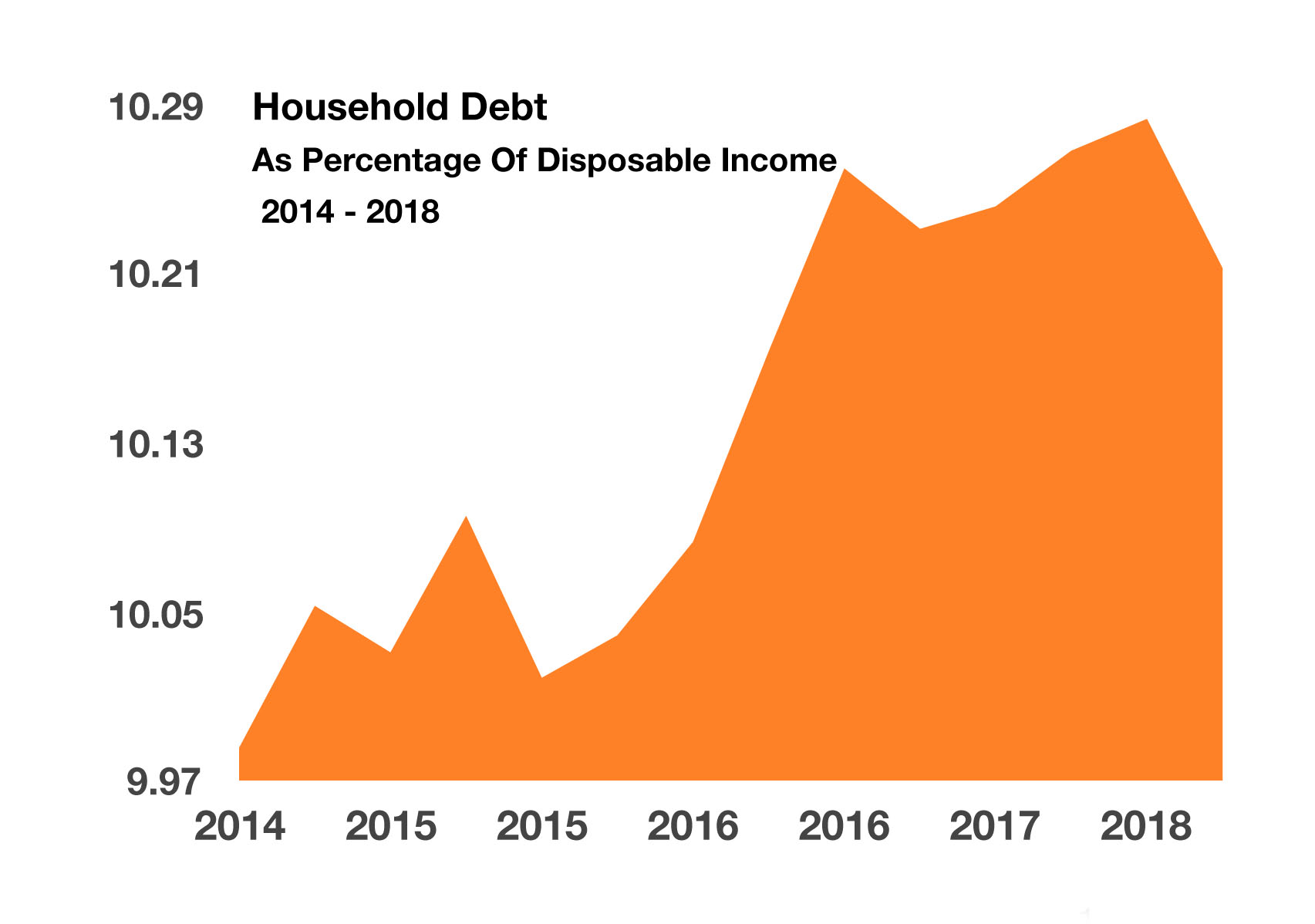

It has been 10 years since the financial crisis of 2008 when financial markets experienced turbulence not seen in decades. An ultra low interest rate environment ensued for nearly a decade after the Federal Reserve began flooding the financial markets with massive amounts of liquidity in order to stem the crisis at hand. Since then, numerous legislation and regulations were implemented providing safety measures and guidelines.

Viewed as an optimistic indicator for the U.S. economy, inflation rose the most in seven years as consumer prices increased at an annual rate of 2.9%. While inflation is an indicator of economic expansion in the economy, wages are not keeping up with rising prices nationwide.

The Congressional Budget Office (CBO) released its summary of the most recent federal budget as of July. Federal spending increased by $143 billion, attributable to increases in Medicare, Medicaid, and Social Security expenditures. There was also a rise in individual taxes, a result of larger withholdings on paychecks which increased by $32 billion. That increase in withholdings reflects recent increases in wages and salaries, meaning that the economy is possibly experiencing more people working and at higher pay rates.

California is due to become the first state to impose a quota for the inclusion of women on the boards of publicly traded companies headquartered in the state. Other states are expected to follow California’s lead by eventually implementing similar mandates.

Various social media and technology companies are facing criticism and possible regulatory oversight regarding the influence they maintain. Many see that the political and cultural clout held by just a few companies may eventually be of concern. (Sources: ECB, IMF, Dept. of Commerce, Bloomberg, http://www.leginfo.legislature.ca.gov, CBO)