Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

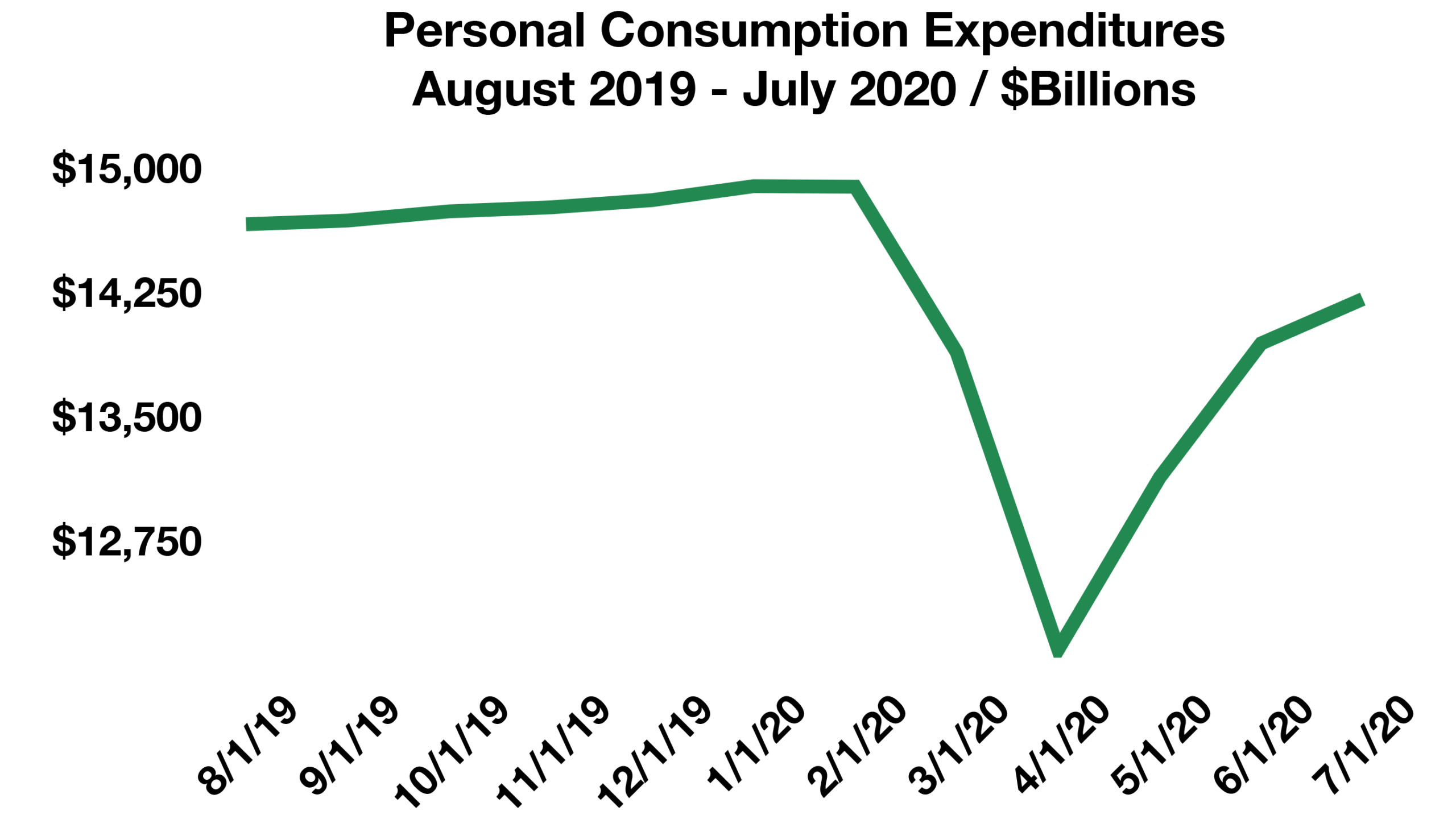

U.S. equity indices rebounded in August to pre-pandemic levels that were last reached in early March of this year. The dramatic recovery in equity valuations occurred rapidly by historic standards and was unexpected by many market analysts and economists.

The Federal Reserve is expected to leave short-term rates near zero for up to five years in order to allow inflation to expand modestly throughout the economy. The Fed believes that inflation will be muted until economic activity picks up again as the effects of the pandemic recede.

The U.S. government mistakenly sent $1.6 billon of stimulus payments to deceased U.S. citizens. The Government Account Office (GAO) reported that the payments were made hastily and without proper verification with other government agency databases, such as Social Security.

The Paycheck Protection Program issued 5.2 million stimulus loans totaling $525 billion through August 8th, when the program closed. Another round of stimulus funding for businesses may be included in a new bill drafted by Congress.

U.S. consumer confidence fell in August to the lowest levels since 2014, as noted by the Conference Board’s index. Sentiment among consumers regarding employment and business expectations was a key factor in the decline of consumer confidence.

The U.S. dollar fell to a two-year low against other global currencies, as expanding government debt issuance and economic uncertainty regarding the novel coronavirus weighed on the currency. Credit rating agency Fitch Ratings revised its outlook on U.S. government debt from stable to negative, citing ongoing deterioration with public finances and the absence of a credible fiscal consolidation plan.

In response to issues with incomplete data, the U.S. Census Bureau began gathering data designed to identify the financial and social impact of the pandemic on the lives of Americans across the country. The experimental Household Pulse Survey, which is compiled by the Census Bureau, started collecting data in April following the onset of the pandemic.

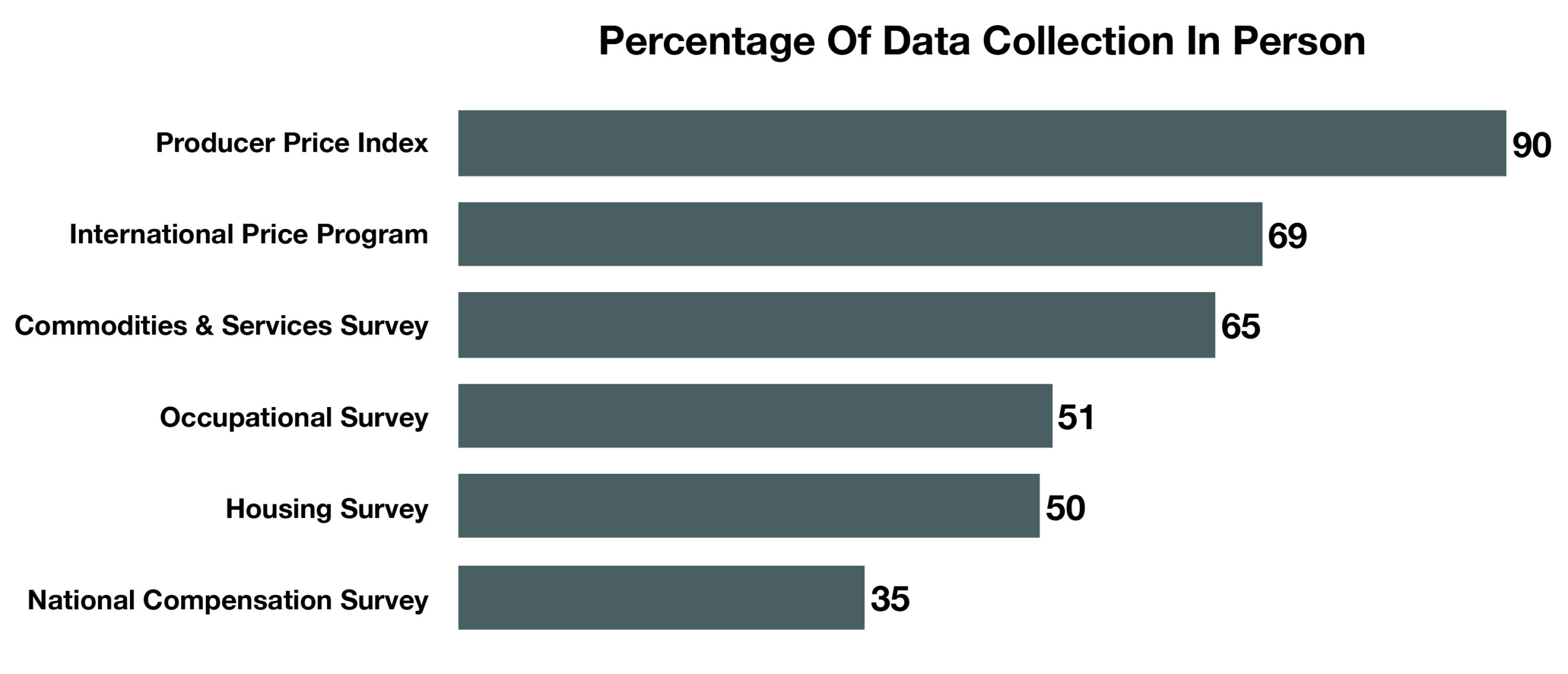

Data collection efforts by several federal agencies and departments have been hindered by the pandemic, raising questions as to the accuracy of data collection affecting various government indices and economic gauges.

Sources: Federal Reserve, GAO, USPS, Moody’s, Fitch Ratings, U.S. Census Bureau