Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 48,063 |

| S&P 500 | 6,845 |

| Nasdaq | 23,241 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.18% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.48% |

YTD Market Returns:

| Dow Jones | 13.07% |

| S&P 500 | 16.46% |

| Nasdaq | 20.36% |

| MSCI-EAFE | 27.89% |

| MSCI-Europe | 31.95% |

| MSCI-Pacific | 29.87% |

| MSCI-Emg Mkt | 30.58% |

| US Agg Bond | 7.30% |

| US Corp Bond | 7.77% |

| US Gov’t Bond | 6.88% |

Commodity Prices:

| Gold | 4,325 |

| Silver | 70.34 |

| Oil (WTI) | 57.42 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 156.18 |

| Canadian /Dollar | 0.73 |

Macro Overview / Sept 2021

As the Delta variant has spread, many companies, schools and government agencies have begun imposing vaccine requirements for employees and students. The World Health Organization has identified 20 Covid variants throughout the world, four of which are categorized as Variants of Concern (VOC).

Supply chain disruptions brought about by the pandemic have fostered inflationary pressures not seen since the late 1970’s. Shortages of essential components and lack of qualified workers have driven prices higher in nearly every industry nationwide.

Federal officials ordered water cuts on the enormous Colorado River system, the first time ever since the Colorado River Compact was drafted in the 1920s. Water from the river serves more than 40 million residents and farmers in Arizona, California, Nevada, Colorado, New Mexico, Utah and Wyoming. Under a treaty signed with Mexico in 1944, water from the Colorado River is also siphoned to farmers in Mexicali. An extensive drought with minimal rainfall for seasons has led to dangerously low reservoir levels, devastated farms, and sparked treacherous forest fires.

Congress proposed a $3.5 trillion spending bill, focused on health, jobs, education, agriculture, and energy. The Senate Finance Committee expects to pay for the bill with taxes on the wealthy and corporations, uncollected taxes, and other measures. Some believe that the additional increase in taxes proposed may not be enough to fund the spending bill.

The Federal Reserve announced that it doesn’t intend to raise interest rates just yet, but does plan on possibly buying fewer mortgage and Treasury bonds later this year, also known as tapering. The Fed’s buying of bonds in the open market has been a form of stimulus support during the pandemic which has helped keep rates low and market conditions fluid.

Financial markets are becoming more in-tune with the evolution of Covid-19 variants, as recent mutations have reintroduced social distancing mandates and begun to influence earnings estimates and economic projections.

Delayed deliveries of imports from Asia are disturbing inventory levels and product sales throughout the U.S. The twin ports of Los Angeles and Long Beach in California reported 44 container ships anchored off the coast at the end of August, exceeding the record of 40 from earlier this year. Labor shortages and Covid safety protocols mandated among container vessels and ports have created supply bottlenecks preventing millions of imported products from getting to stores and consumers.

The U.S. Supreme Court voted to allow evictions for those not paying rent. Even though the decision affects renters and landlords nationally, various cities and states have extended eviction moratoriums and will continue to enforce a ban on evictions. It is estimated that approximately 10 million people nationwide are behind on their rent payments.

Consumer sentiment fell in August due to uncertainty surrounding the Covid variants and inflationary pressures weighing on spending decisions. The University of Michigan, which compiles and releases the Index of Consumer Sentiment each month, reported a 13.4% decrease in August from July, the largest monthly decline since 2005 following hurricane Katrina.

Sources: https://www.who.int/en/activities/tracking-SARS-CoV-2-variants/, Federal Reserve, WHO, Port of L.A., congress.gov

Global Equities Stay Steady In August – Equity Update

Global equity markets advanced in August amidst growing concerns surrounding Covid variant threats. Continued supply issues of critical components for various products weighed on earnings estimates, as many companies struggle to rebuild inventory. Higher prices for some services and products are sustaining revenues and margins for various companies.

Major equity indices all posted higher gains in August, elevating both large and small capitalized companies. International markets also faired well for the month, as developed and emerging equity indices saw increases.

Sources: Bloomberg, Reuters

Bond Yields Starting To Feel Pressure – Fixed Income Update

The Federal Reserve announced that it anticipates alleviating bond buying possibly later this year, yet with no imminent interest rate increases for now. The Fed’s pull back in bond buying is known as tapering, when stimulus support starts to unwind.

Ironically, any pull back in bond buying is expected to lead to higher rates, an indirect consequence of tapering. Yields on Treasury bonds maturing from 2 to 30 years all saw slight increases, interpreted by economists as a shift up in the yield curve, meaning that economic expansion is possible and that inflationary pressures are looming.

Sources: Fed, U.S. Treasury

Conversion of Traditional IRA to ROTH

Example # 1 – Full Conversion Harold has two IRA accounts. One is a contributory IRA and the other is a SIMPLE IRA and the total value of both is $22,000. Since inception, Harold has contributed $9,000 as non-deductible contributions. He now decides to convert both IRAs to ROTH accounts. Because all his accounts are being closed, the $9,000 non-deductible amount is considered to be basis and is distributed tax free.

Example # 2 – Partial Conversion John has three IRA accounts including a contributory IRA to which he has contributed $14,000 after tax, a SIMPLE IRA, and a rollover IRA. The contributory IRA balance is $29,000; the SIMPLE IRA balance is $23,000, and the rollover account balance is $60,000. Only the contributory IRA and the SIMPLE IRA are being converted to ROTH accounts. All three accounts must be taken into consideration in determining the taxable portion of the distribution: $14,000 / ($29,000 + $23,000 + $60,000) = 0.1250 $52,000 x 0.1250 = $ 6,500 tax free distribution $ 45,500 taxable distribution Remaining basis in the rollover IRA $ 7,500 Example # 3 – Allocation of Basis Rachel owns a traditional IRA with a value of $125,000 with a basis of $25,000. She takes a distribution of $125,000, converts $100,000 to a Roth IRA and keeps $25,000. Her basis of $25,000 cannot be attributed to the portion of the account that she keeps. The basis is allocated as followed: $100,000 Conversions $ 20,000 Basis recovered $25,000 Kept $ 5,000 Basis recovered Example # 4 – ROTH Conversion from after-tax 401(k) Jane has $100,000 in a Traditional 401(k), $25,000 in non-deductible contributions, $10,000 in gains attributable to the after tax contributions, $45,000 in deductible contributions and $20,000 in gains attributable to the deductible contributions. Jane leaves her employer and decides to roll over her old 401(k) into both a traditional IRA and a ROTH IRA account. The non-deductible contributions are rolled into a ROTH IRA. The basis for the non-deductible contributions is $10,000. The taxable distribution for the rollover is $10,000. The amount of the total conversion less basis equals the taxable gain. This is equal to the taxable distribution. The full $65,000 from the deductible contributions and gain rolled into a traditional IRA is a non-taxable roll-over.

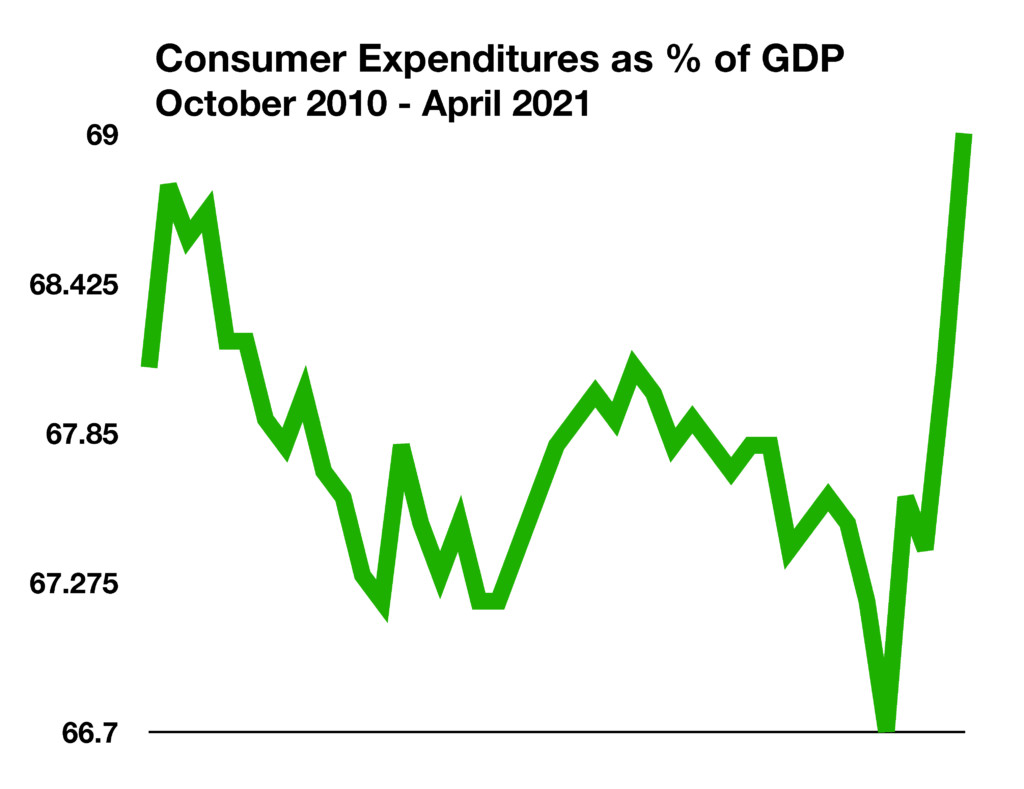

Consumers Drive Economic Growth, Not Government – Consumer Expenditures

Each month the Department of Commerce releases its Gross Domestic Product (GDP) report. This report is the single most recognized indicator of how the economy is performing.

GDP is made up of private consumption, gross investment, government spending, and net exports. The single largest contributor of these components is consumer consumption, making nearly 70% of GDP.

Historical data provided by the Bureau of Labor Statistics shows that U.S. economic growth has steadily become more reliant on consumer expenditures. Consumer expenditures as a percentage of GDP have risen to their highest levels over the past three years since the end of World War II. The importance of how much we consume as consumers each and every day has become that much more significant.

Additional data from the Fed shows that consumers have also adjusted their spending behaviors, relying less on credit and more on government stimulus payments to spend, vastly different from the peak of easy credit seen in 2004-2006.

Sources: Commerce Department, BLS, Federal Reserve

**Market Returns: All data is indicative of total return which includes capital gain/loss and reinvested dividends for noted period. Index data sources; MSCI, DJ-UBSCI, WTI, IDC, S&P. The information provided is believed to be reliable, but its accuracy or completeness is not warranted. This material is not intended as an offer or solicitation for the purchase or sale of any stock, bond, mutual fund, or any other financial instrument. The views and strategies discussed herein may not be appropriate and/or suitable for all investors. This material is meant solely for informational purposes, and is not intended to suffice as any type of accounting, legal, tax, or estate planning advice. Any and all forecasts mentioned are for illustrative purposes only and should not be interpreted as investment recommendations.