Derek J. Sinani

Founder/Managing Partner

derek@ironwoodwealth.com

7047 E. Greenway Parkway, Ste. 250

Scottsdale, AZ 85254

480.473.3455

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview: As the Delta variant has spread, many companies, schools and government agencies have begun imposing vaccine requirements for employees and students. The World Health Organization has identified 20 Covid variants throughout the world, four of which are categorized as Variants of Concern (VOC).

Supply chain disruptions brought about by the pandemic have fostered inflationary pressures not seen since the late 1970’s. Shortages of essential components and lack of qualified workers have driven prices higher in nearly every industry nationwide. Will inflation be sticky or transitory – the million-dollar question.

Federal officials ordered water cuts on the enormous Colorado River system, the first time ever since the Colorado River Compact was drafted in the 1920s. Water from the river serves more than 40 million residents and farmers in Arizona, California, Nevada, Colorado, New Mexico, Utah and Wyoming. An extensive drought with minimal rainfall for seasons has led to dangerously low reservoir levels, devastated farms, and sparked treacherous forest fires.

Congress proposed a $3.5 trillion spending bill, focused on health, jobs, education, agriculture, and energy – are higher taxes on the horizon?

The Federal Reserve announced that it doesn’t intend to raise interest rates just yet, but does plan on possibly buying fewer mortgage and Treasury bonds later this year, also known as tapering. The Fed’s buying of bonds in the open market has been a form of stimulus support during the pandemic which has helped keep rates low and market conditions fluid. I’ve proactively made adjustments to the bond portion of our portfolio to address this looming investment risk.

Delayed deliveries of imports from Asia are disturbing inventory levels and product sales throughout the U.S. The twin ports of Los Angeles and Long Beach in California reported 44 container ships anchored off the coast at the end of August, exceeding the record of 40 from earlier this year. Labor shortages and Covid safety protocols mandated among container vessels and ports have created supply bottlenecks preventing millions of imported products from getting to stores and consumers. After seven years, I’m replacing my trusty Ford F-150, but the global computer chip shortage has made this unpleasant task, even more unpleasant with little new car inventory and long delivery waits.

The U.S. Supreme Court voted to allow evictions for those not paying rent. Even though the decision affects renters and landlords nationally, various cities and states have extended eviction moratoriums and will continue to enforce a ban on evictions. It is estimated that approximately 10 million people nationwide are behind on their rent payments. We all feel bad for renters in the rears, but sadly, this is having a profoundly negative impact on many mom-and-pop landlords.

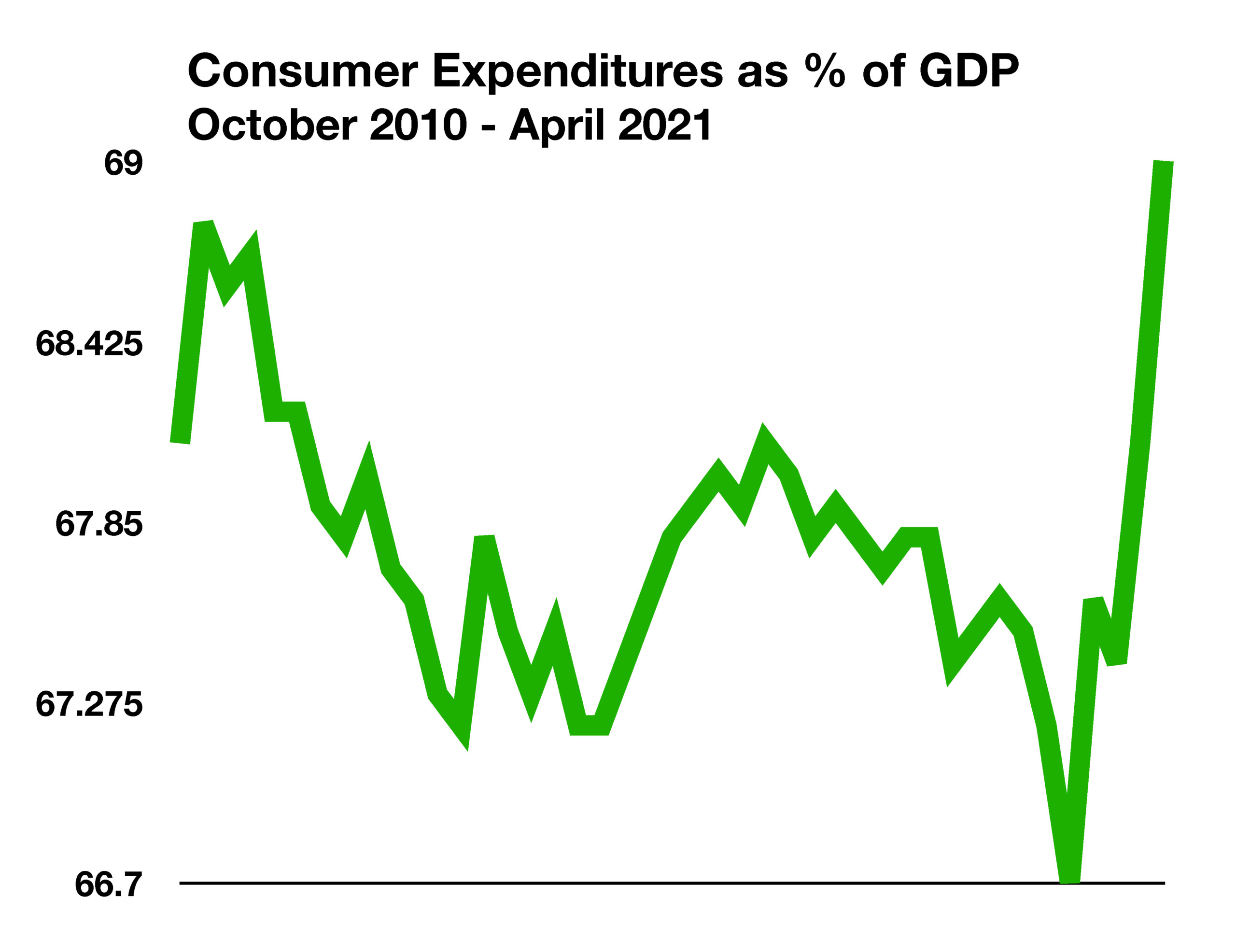

Consumer sentiment fell in August due to uncertainty surrounding the Covid variants and inflationary pressures weighing on spending decisions. The University of Michigan, which compiles and releases the Index of Consumer Sentiment each month, reported a 13.4% decrease in August from July, the largest monthly decline since 2005 following hurricane Katrina.