Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

An increasing number of companies, schools and government agencies are imposing vaccine requirements for employees and students. The World Health Organization has identified 20 COVID-19 variants throughout the world, four of which it categorizes as variants of concern (VOC). Supply chain disruptions brought about by the pandemic have contributed to inflationary pressures not seen since the late 1970’s. Shortages of essential components and lack of qualified workers drove prices higher in nearly every industry nationwide.

Federal officials ordered water cuts across the enormous Colorado River system, the first time ever since the Colorado River Compact was drafted in the 1920s. Water from the river serves more than 40 million residents and farmers in Arizona, California, Nevada, Colorado, New Mexico, Utah and Wyoming. Under a treaty signed with Mexico in 1944, water from the Colorado River is also siphoned to farmers in Mexicali. An extensive drought with minimal rainfall for the past several seasons has led to dangerously low reservoir levels, devastated farms, and sparked treacherous forest fires.

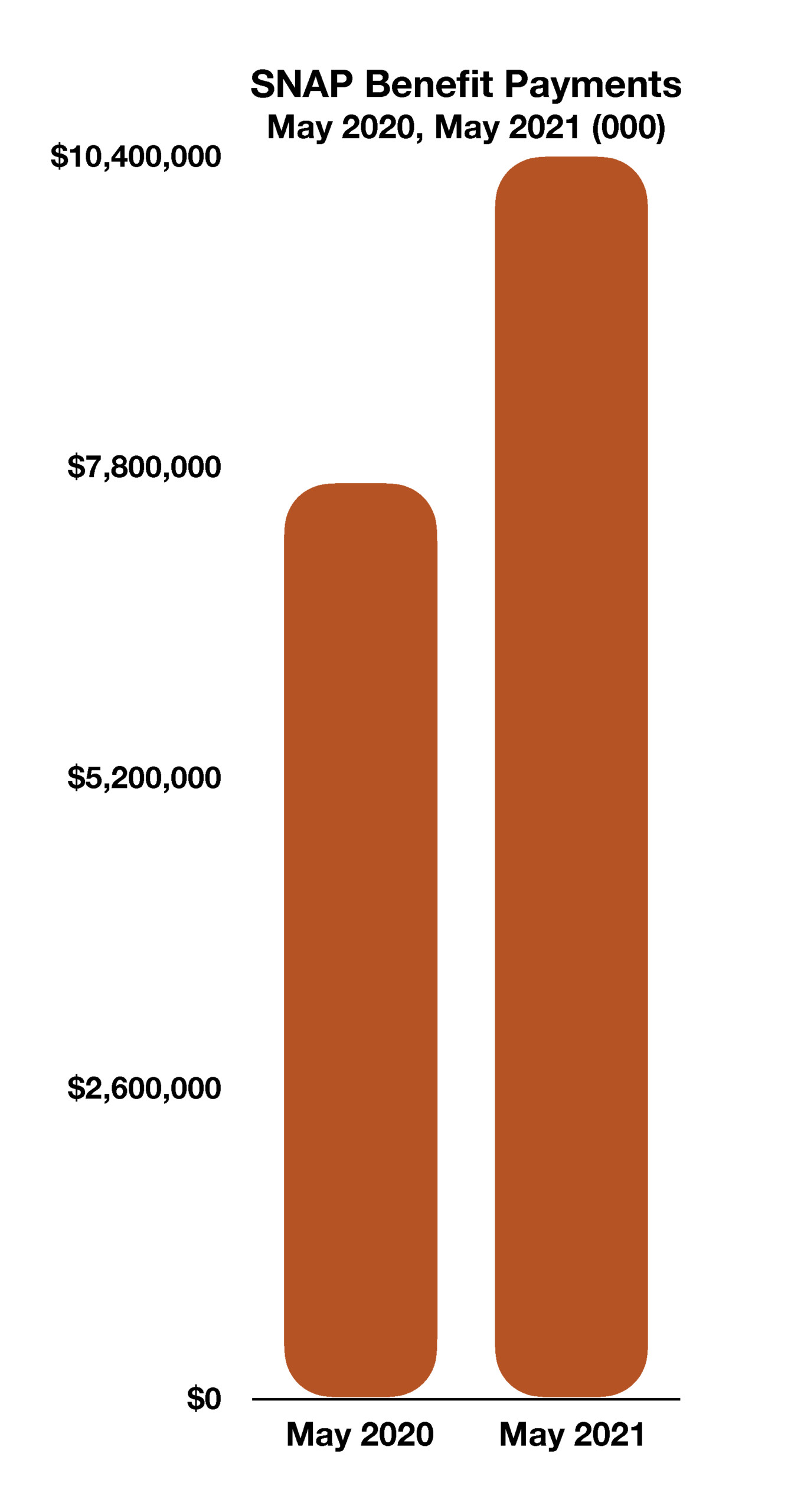

Congress proposed a $3.5 trillion spending bill, focused on health, jobs, education, agriculture, and energy. The Senate Finance Committee expects to pay for the bill with taxes on the wealthy and corporations, outstanding uncollected taxes, and other measures. Some budget analysts anticipate that the additional increase in taxes proposed may not be enough to fund the spending bill.

The Federal Reserve announced that it doesn’t intend to raise interest rates yet, but plans on potentially buying fewer mortgage and Treasury bonds later this year, a move also known as tapering. The Fed’s purchase of bonds in the open market has been a form of stimulus support during the pandemic, helping to keep rates low and providing liquidity in financial markets.

Delayed deliveries of imports from Asia depressed inventory levels and product sales throughout the U.S. The twin ports of Los Angeles and Long Beach in California reported 44 container ships anchored off the coast at the end of August, exceeding the record of 40 from earlier this year. Labor shortages and coronavirus safety protocols mandated for container vessels and ports have created supply bottlenecks, preventing millions of imported products from reaching stores and consumers.

The U.S. Supreme Court voted to allow evictions for those not paying rent. Although the decision affects renters and landlords nationally, various cities and states have extended eviction moratoriums and will continue to enforce a ban on evictions. It is estimated that approximately 10 million people nationwide are behind on their rent payments.

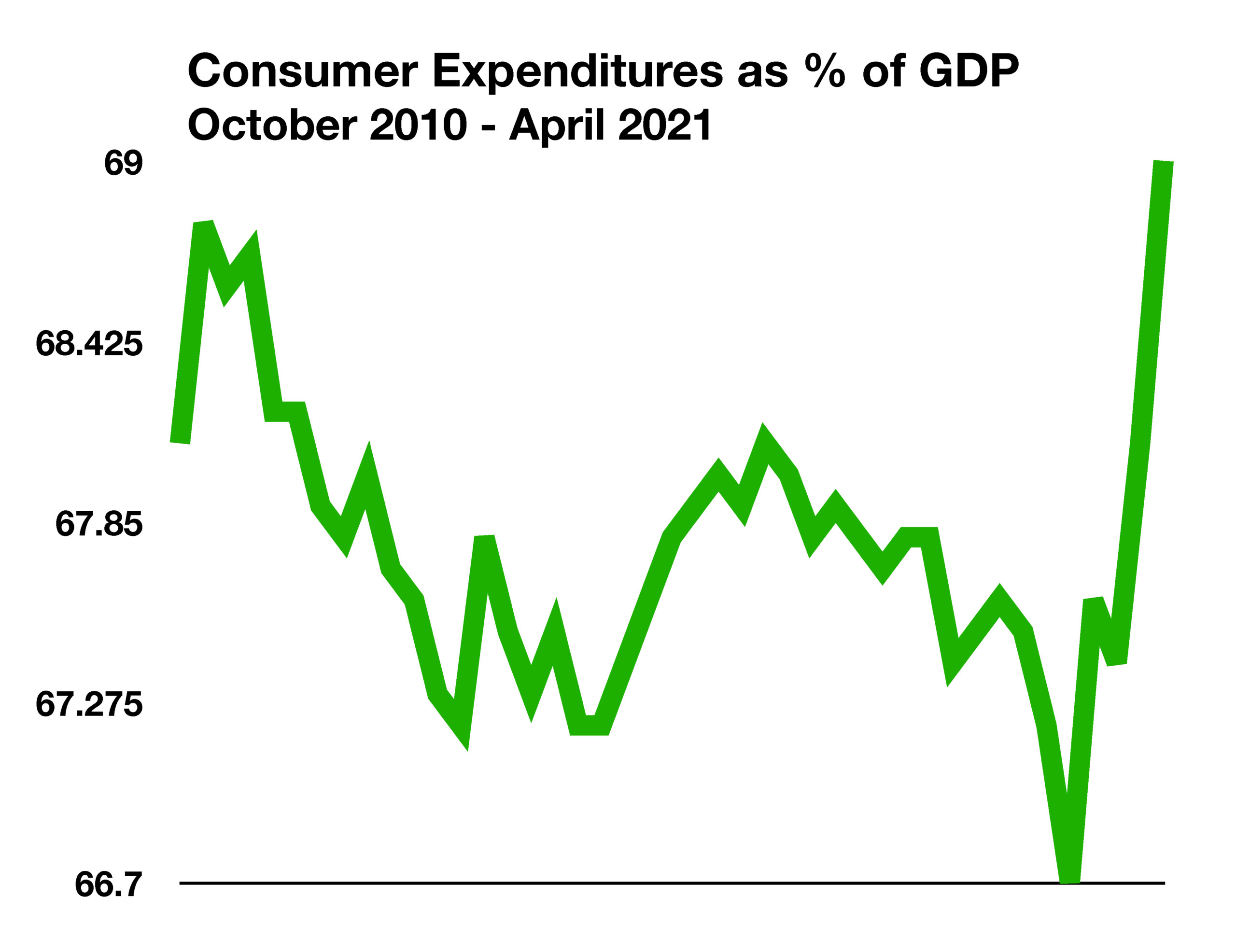

Consumer sentiment fell in August due to uncertainty regarding the COVID-19 variants and inflationary pressures. The University of Michigan, which compiles and releases the Index of Consumer Sentiment each month, reported a 13.4% decrease in August from July, the largest monthly decline since 2005 following hurricane Katrina. (Sources: https://www.who.int/en/activities/tracking-SARS-CoV-2-variants/, Federal Reserve, WHO, Port of L.A., congress.gov, U.S. Department of the Interior)