Jason Napoli, ChFC, AAMS, MBA

President and Chief Investment Officer

High Country Capital Management

970.249.3499

www.hccm.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

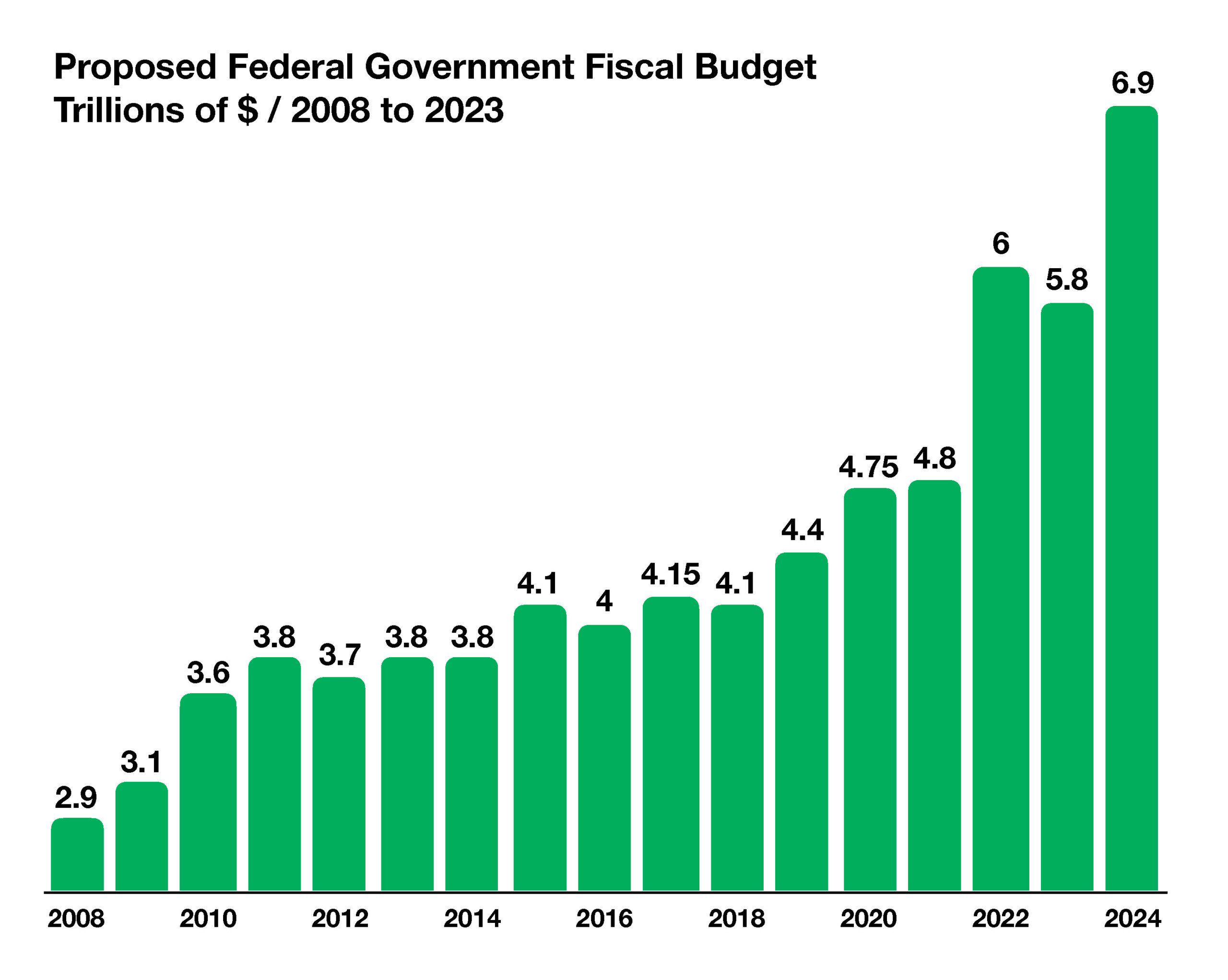

Congress is spending the bulk of September deliberating over the Federal Budget for fiscal year 2024 as a looming deadline on September 30th approaches. Should an agreement not be reached, then a government shutdown could occur. The $6.9 trillion proposed budget encompasses 438 agencies as well as 15 executive branches of the Federal Government.

The most recent Federal Government shutdown lasted 35 days, from December 22, 2018, until January 25, 2019, making it the longest Federal Government shutdown in history. Partial government shutdowns have also occurred in the past, shuttering selected federal agencies and programs.

Recently released Federal Reserve data is revealing an erosion in consumer credit quality, with a particular increase in retail store credit card delinquencies. Credit card usage has accounted for roughly 20% of consumer spending growth over the past year.

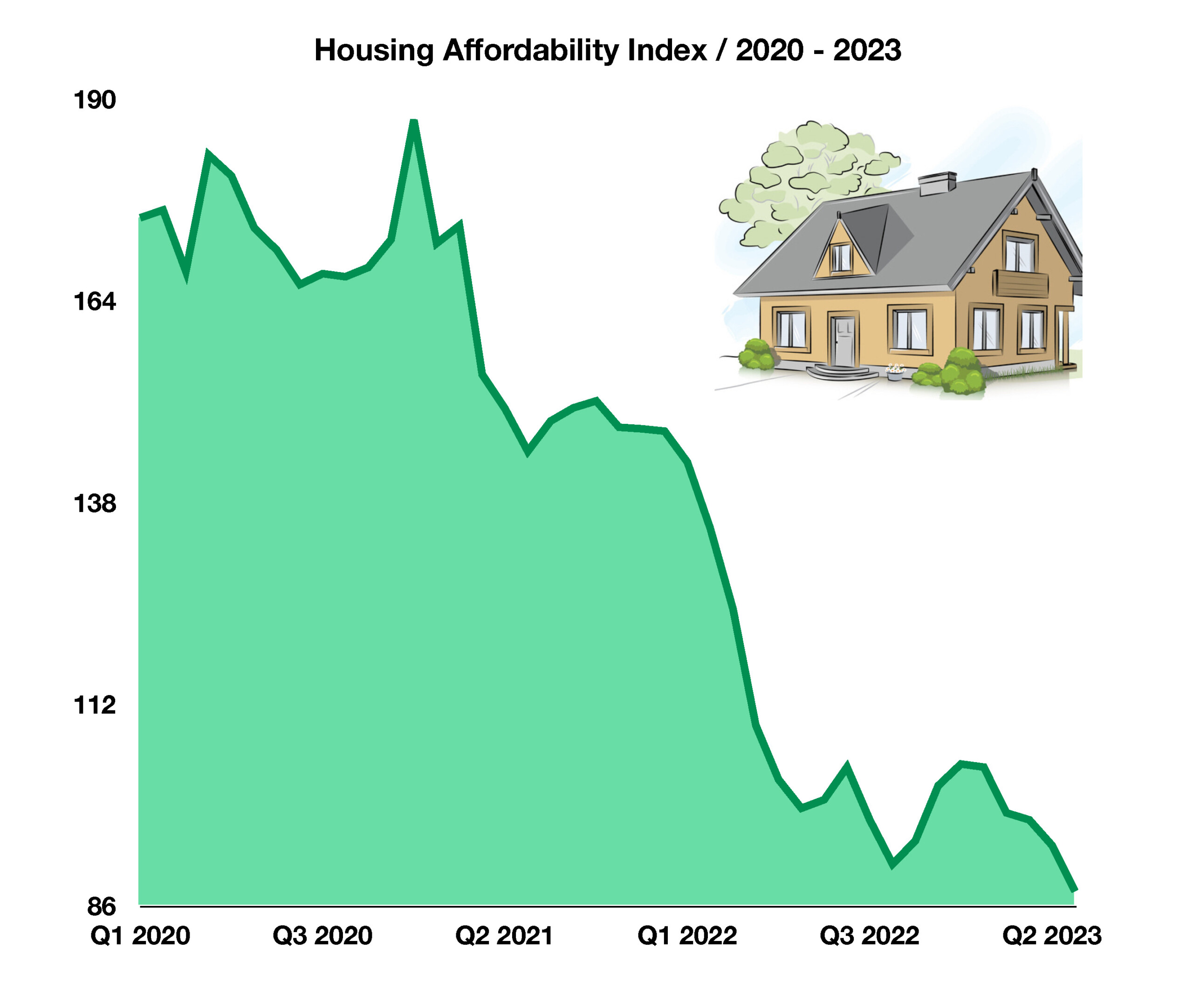

The rate on a 30-year fixed conforming mortgage fell to 7.18% in August, after reaching a 23-year high of 7.23%. The resilience of the housing market has become questionable by many analysts and economists, as elevated home prices continue to make purchases unaffordable for millions of Americans. The cost of apartment and residential rentals are starting to decrease in various areas of the country, as an additional inventory of rentals has been coming onto the market.

Equities retracted in August as contentious earnings estimates and lingering inflation risks held stocks back from advancing. Supply constraints that existed a year ago have essentially vanished, yet have led many companies to explore new sourcing locations and facilities. China, the world’s largest exporting country, is showing signs of a possible economic contraction, seen by analysts as a potential hindrance to global expansion.

Petroleum production cuts by OPEC and other oil-producing countries propelled oil and gasoline prices higher in August. Other factors affecting oil prices as fall approaches include seasonality, demand, and supply constraints. Oil ended August at $83.60 per barrel, yet still lower than the recent highs of over $120 per barrel in June 2022. (Sources: U.S. Congress, Federal Reserve Bank of St. Louis, IMF, Bureau of Labor Statistics, FreddieMac)

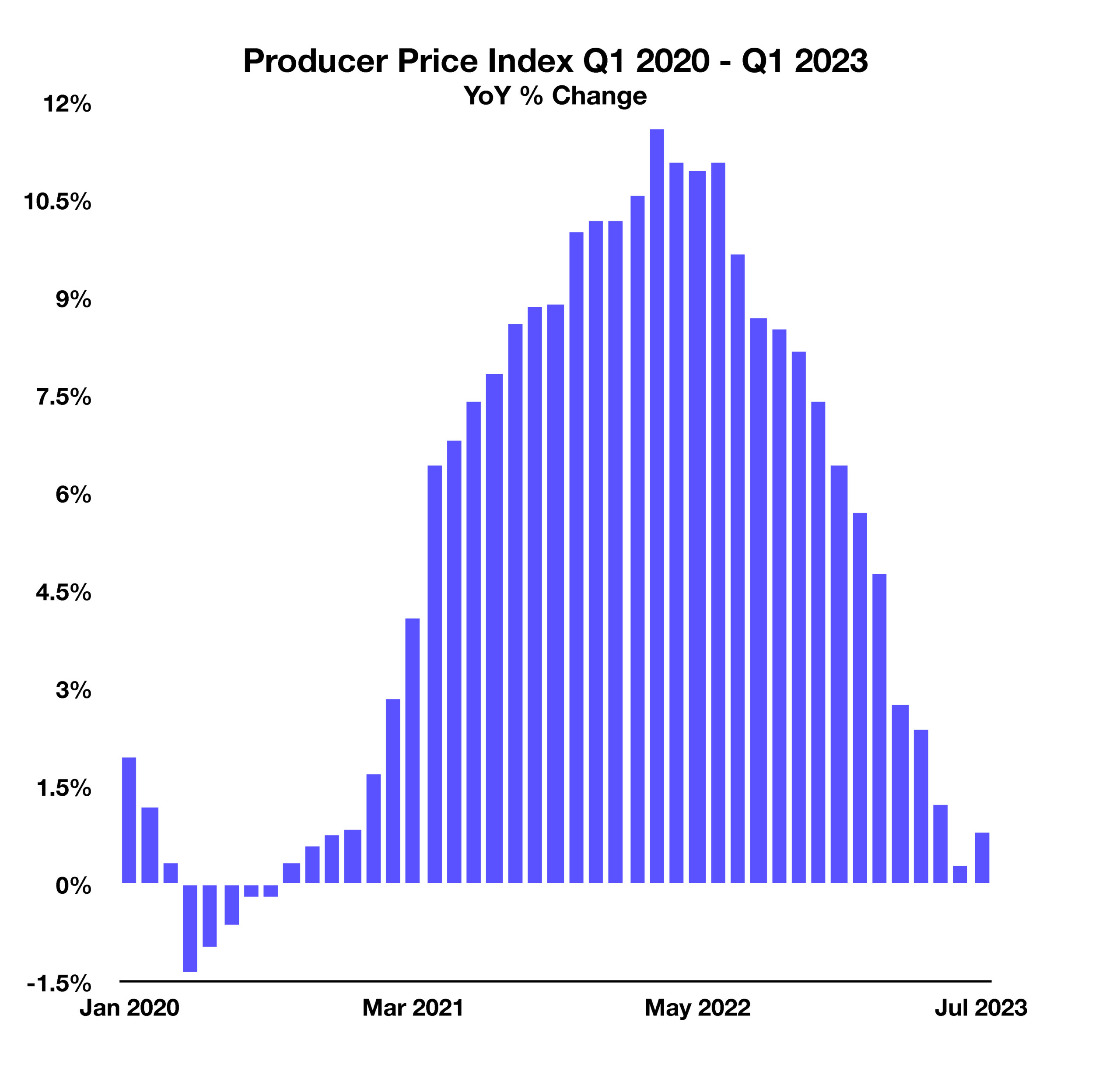

The Producer Price Index (PPI) measures the selling prices domestic companies receive when purchasing everything from raw materials to products themselves. Similar to how the Consumer Price Index (CPI) tracks prices consumers pay for goods, the PPI tracks prices that corporations pay.

The Producer Price Index (PPI) measures the selling prices domestic companies receive when purchasing everything from raw materials to products themselves. Similar to how the Consumer Price Index (CPI) tracks prices consumers pay for goods, the PPI tracks prices that corporations pay.