Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Dear Friends,

The US economy has yet to present a problem that capitalism has not solved.

Most everyone thought we would be in a recession by now as punishment for our excessive pandemic spending. Instead, wages continue to rise and demand for everything is keeping prices high. Expansionary economic policies and subsequent indebtedness of the USA of the past decade have yet to cause a problem and the S&P500 has returned 10% in the last 12 months as of this writing. It seems we are climbing a plateau, but cannot see beyond. The frenzy of growth is dissipating and people are looking more closely at how much risk they want to carry going forward.

We are proceeding cautiously now and investing in mostly safe things. It’s not because of any fear of the future. Prudent investors are not fearful. And it is important to be cognecent that as time passes, so do opportunities.

Most significantly, long term rates have increased to as high as 4.8% for the 10 year treasury. Many portfolios have felt the impact of this as significant losses in their bond funds, supposedly the safe part. Diversification can be a real pain sometimes!

Recently some important investing behaviors appear to be changing: borrowers are getting pinched as their rates become reset and simultaneously investors can make 5% risk-free in a CD (That is about 20 times what it was only 2 years ago!). Money is now expensive. “The effects will come; just wait. In the first year of the pandemic, many borrowers locked in low-cost funding for many years, effectively delaying any day of reckoning. ” (WSJ). Perhaps

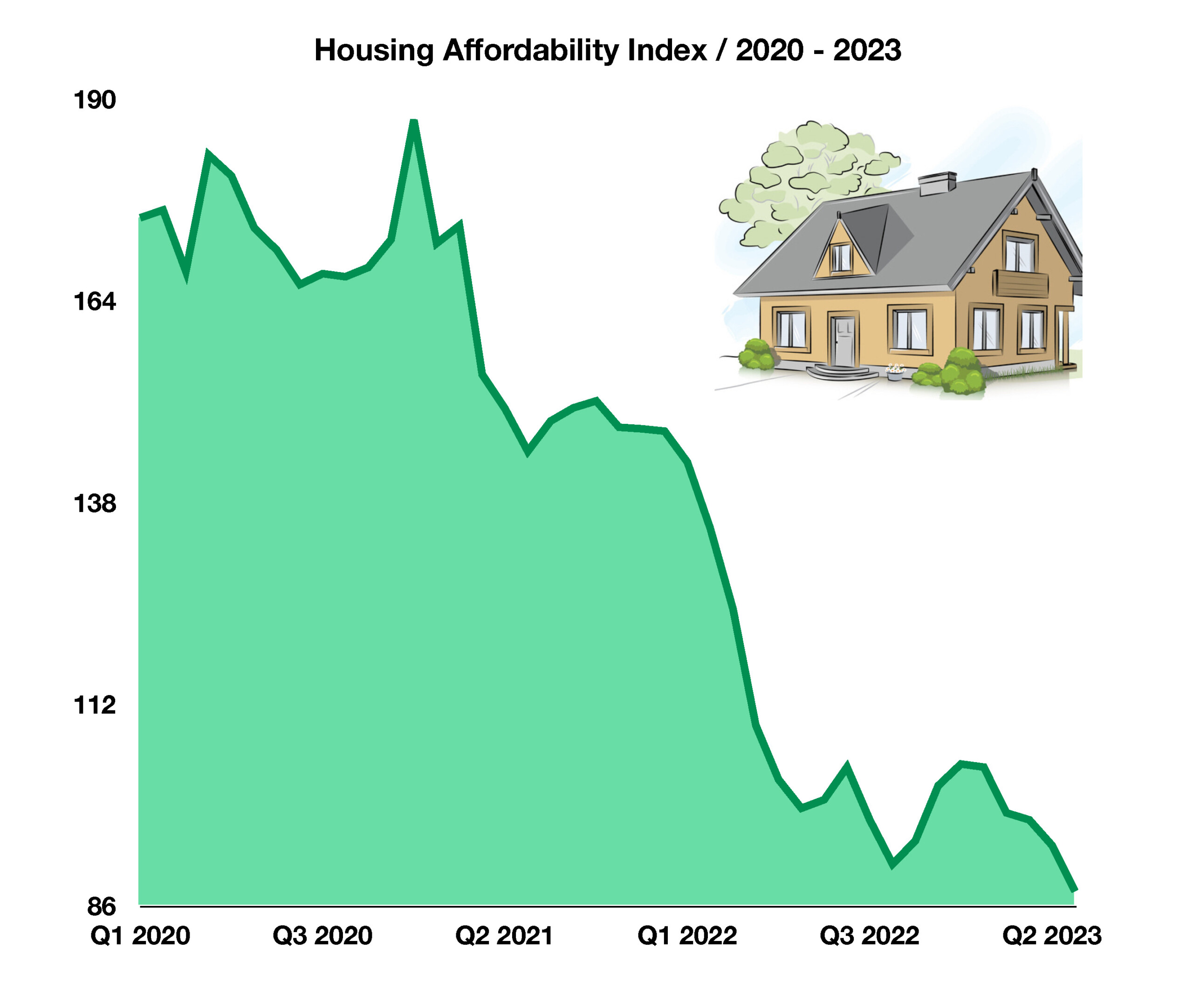

This newsletter has a cautious bent. Worry some numbers are appearing on housing, mortgages, and our reliance on revolving credit. Things that used to work no longer do. We see investment opportunities shifting and are taking incremental action and seizing opportunities to enhance the security of our client portfolios. Persisting with our continued faith in the US economy means that whatever the Fall brings, there will be a Santa Claus rally. Us, the consumer, will make sure it does! The economy has yet to present a problem that capitalism has not solved.

Unclear where the top is.

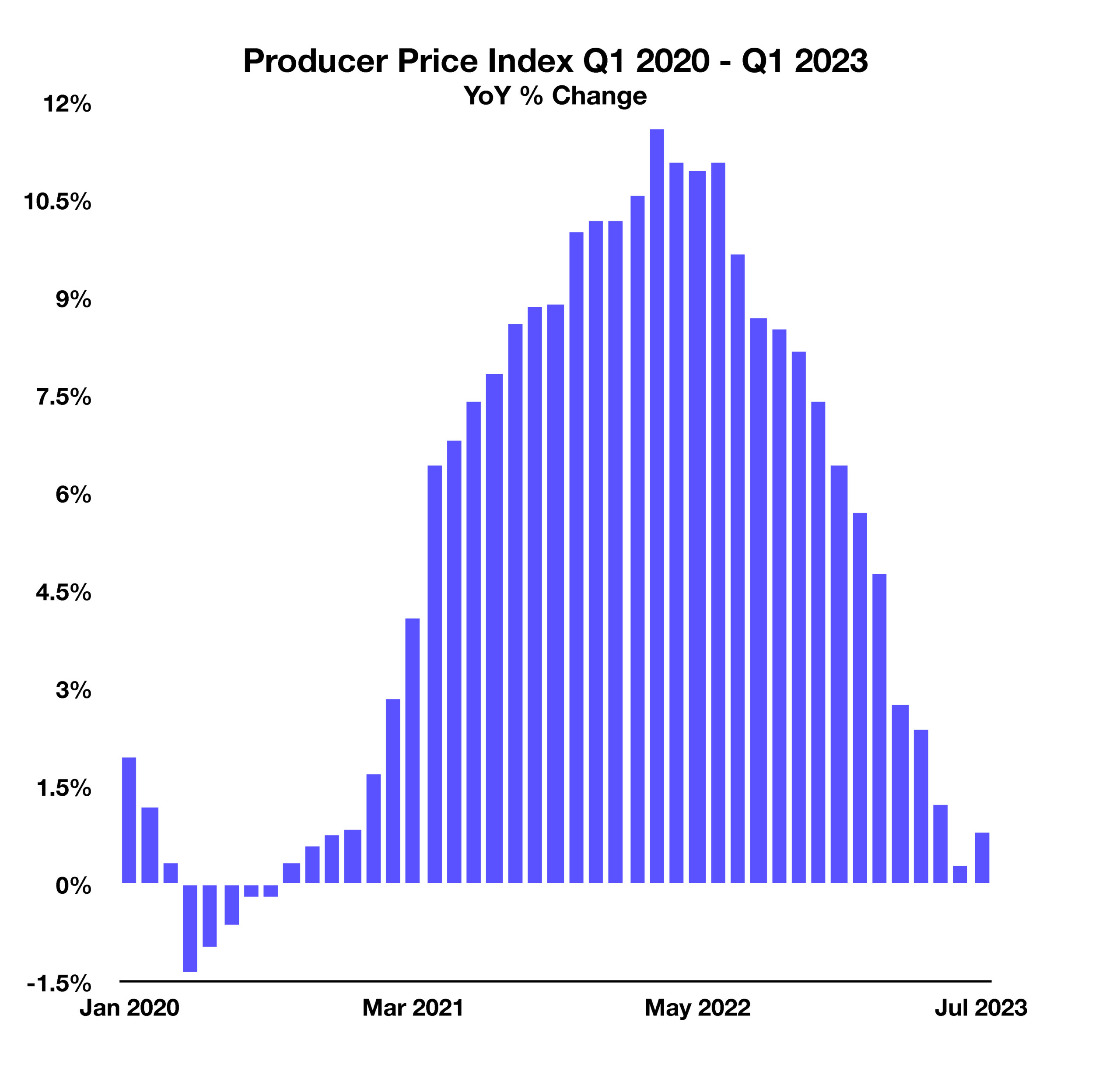

The Producer Price Index (PPI) measures the selling prices domestic companies receive when purchasing everything from raw materials to products themselves. Similar to how the Consumer Price Index (CPI) tracks prices consumers pay for goods, the PPI tracks prices that corporations pay.

The Producer Price Index (PPI) measures the selling prices domestic companies receive when purchasing everything from raw materials to products themselves. Similar to how the Consumer Price Index (CPI) tracks prices consumers pay for goods, the PPI tracks prices that corporations pay.