Douglas Castro

ADC Wealth Management, LLC

30D Broadaway, Suite 200

Massapequa, NY 11758

516.308.7514

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

A Higher Rate of Inflation

The talk of inflation and interest rates has been in the papers for years now, with people on the edge of their seats wondering what the Fed’s next move will be in order to combat the inflation. This talk is nothing the news has not seen before, great bouts of differences in the inflation rate

have occurred over time and each time the economy cycles back to a tolerable place. In this memo we will go over what recent events have caused the inflation we’re seeing today, how the neutral rate of inflation may be raised, and where we could possibly see inflation going.

Causes of Inflation

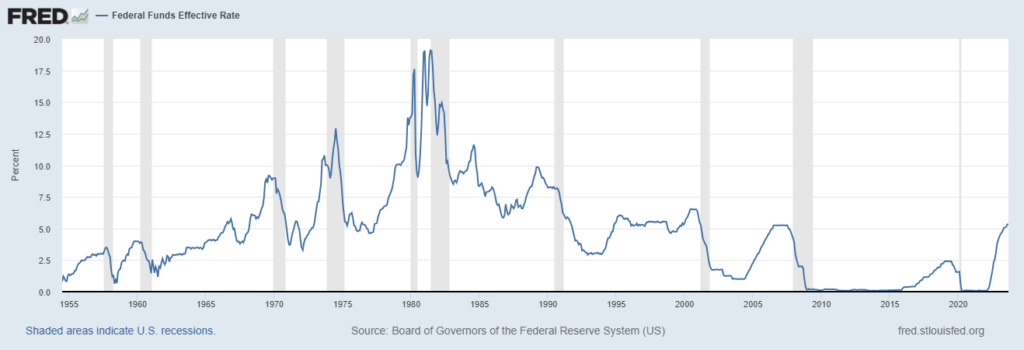

As defined by the United States Department of Labor, inflation is the overall general upward price movement of goods and services in an economy. Inflation is associated with too much demand and not enough supply, or a rapid growth of the money supply (CITE HBR). With COVID, the people of the United States have experienced intense changes with the different lifestyle the country sustained for not only the months of lockdown, but also the following two years. Because of the lifestyle change, the economy changed alongside it. We went from record low interest rates during the pandemic record to very high interest rates in an attempt to curb inflation. Numerous factors contribute to the increased rate of inflation besides the mentioned causes, however they are not as direct. What some may say, others may disagree with, because the intricacies of how the economy functions (i.e. why it functions the way it does) cannot be pinpointed to one sole cause. Monetary policy, government spending, a change in what society needs, and a great amount of other events can cause an increase in inflation. It should be no

surprise that with the economy going through unforeseen events in 2020 and changing monetary policy that we are in a volatile economy.

Shown above: Federal Funds Effective Rate. The Federal Funds Effective Rate is the interest rate that depository institutions trade federal funds with each other overnight. Typically, a lower cost of borrowing can lead to overborrowing and inflation.