Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

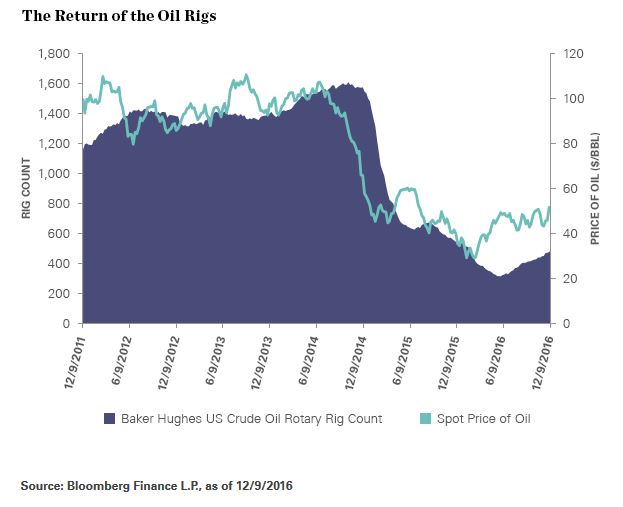

Energy Exposure

Recently we added energy exposure to our investment strategies. Within the tactical strategy, we added exposure to the First Trust Energy ETF (FXN) that invests in the integrated oil companies like Exxon and Chevron. Within the strategic strategy, we added exposure to the First Trust Energy Infrastructure Fund (EMLP) that invests in pipelines that transport the oil and gas from the wells, to the processing plants, and eventually to the consumer. Our decision to add energy exposure was due to President Trump’s pro-energy plan and the planned OPEC production cuts. We expect energy prices to continue to rise in 2017 as the economy picks up momentum and the US continues down the path of energy independence.

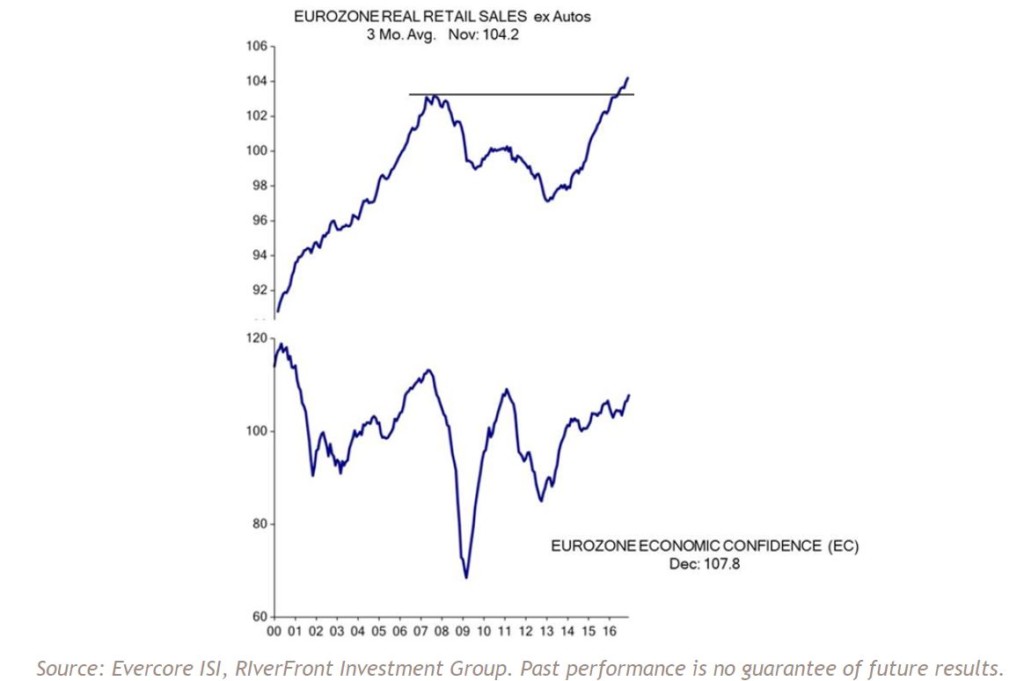

European Equity Exposure

Shamrock’s Tactical Strategy added exposure to European equities with the addition of the First Trust Europe AlphaDex Fund (FEP). Despite concerns surrounding the European Union and the stability of the Euro, retail sales (excluding autos) and general economic confidence have improved since the back to back recessions that ended in 2014. Preliminary PMI surveys of 2017 suggest that the Euro and its two largest economies, Germany and France, started the year strongly. January manufacturing PMI for the eurozone was reported at 55.1 (expansion reading greater than 50). Additionally, Europe has plenty of spare capacity and a central bank that is still expanding its balance sheet, which should make it a prime beneficiary of stronger global growth.