2018 Review

2018 will be remembered as the year that volatility returned with a vengeance and investors began to remember that markets could go down as well as up. It was quite a rollercoaster early on as stocks dropped precipitously in February, rallied all the way back in March only to drop again by the end of March. Then tech took over and pushed the markets to new all time highs in September only to become very ugly again in October. We went from the “synchronized global growth” rally cry by the pundits in January to “it’s the end of the bull market – a recession is imminent” by October. There were many factors at play from rising interest rates, political turmoil and trade wars. By the fourth quarter we finally heard the “imminent credit crisis” drum beating throughout the financial media – something we have been warning about since the inception of this newsletter. The table below shows key indexes, rates and spreads for 2018.

| INDEX | 2018 OPEN | 2018 HIGH | 2018 LOW | 12/19/2018 | CHANGE |

| Dow Jones | 24,719 | 26,828 | 23,294 | 24,527 | -5.69% |

| Nasdaq | 6,903 | 8,109 | 6,594 | 7,098 | -4.40% |

| S&P | 2,673 | 2,930 | 2,523 | 2,651 | -5.55% |

| Barclays Agg Bond Index | 2,046 | 2,042 | 1,986 | 2,025 | -0.48% |

| 10 Year Treasury | 2.40% | 3.23% | 2.40% | 2.75% | +35 bps |

| Fed Funds | 1.40% | 2.19% | 1.40% | 2.19% | +79 bps |

| High Yield Spreads | 3.55% | 4.56% | 3.16% | 4.56% | +111 bps |

| IG Spreads | 0.98% | 1.52% | 0.90% | 1.52% | +54 bps |

Looking at this table it should be obvious that in 2018 stock investors suffered a lot of anxiety and essentially and were down approximately 5% on all three major indexes as of the writing (12/19/28). Nervous investors were logging in daily to check their account balances only to find on some days they were down 2%, 3% or even 5% or more in a day. In October and November alone the Dow closed up or down 5% or more SIX times (not counting inter-day moves which would have made it many more). Through November 90% of all asset classes had negative returns for the year, the third highest in history behind only 1901 and 1920. We are finally beginning to feel the effects of the unprecedented asset manipulation by global central banks and the truth is we are in unchartered waters and while it is anyone’s guess as to how this will end we can certainly use common sense to make some educated predictions (and we will later in this article)

NEXT PAGE : INTEREST RATE REVIEW

The 10-year treasury opened the year right at 2.40% and rose to nearly 3.0% for the first time since 2014 by March. Interest rates tracked the volatility in the stock market for much of the year rising to 3.23% in September before plummeting to 2.85% as the stock market moved into correction territory. Investors began the year believing that the Fed could engineer a soft landing and would be raising the Fed Funds rate 3 times in 2018 and at least 3 times in 2019. After the market carnage in the fourth quarter the debate quickly became whether the Fed should raise at all – estimates for Fed Funds rate hikes quickly went from 3 hikes in 2019 to 1 by many economist. The consensus for where the 10-year treasury would be in 2019 moved from 3.53% to 3.29% with many credible analyst believing it could end up below 3% next year. It is our current view that the current rally in bonds (lower rates) is over-done in the short run and we could see a quick move back over 3% in the first quarter of 2019. The Fed will likely hike the Fed Funds rate in December, after that it is a fools game to guess what 2019 brings. There are multiple macroeconomic factors at play that could not only cause the Fed to pause but to actually begin to cut rates again by late 2019 or early 2020. We will discuss these events later in this newsletter.

The 10-year treasury opened the year right at 2.40% and rose to nearly 3.0% for the first time since 2014 by March. Interest rates tracked the volatility in the stock market for much of the year rising to 3.23% in September before plummeting to 2.85% as the stock market moved into correction territory. Investors began the year believing that the Fed could engineer a soft landing and would be raising the Fed Funds rate 3 times in 2018 and at least 3 times in 2019. After the market carnage in the fourth quarter the debate quickly became whether the Fed should raise at all – estimates for Fed Funds rate hikes quickly went from 3 hikes in 2019 to 1 by many economist. The consensus for where the 10-year treasury would be in 2019 moved from 3.53% to 3.29% with many credible analyst believing it could end up below 3% next year. It is our current view that the current rally in bonds (lower rates) is over-done in the short run and we could see a quick move back over 3% in the first quarter of 2019. The Fed will likely hike the Fed Funds rate in December, after that it is a fools game to guess what 2019 brings. There are multiple macroeconomic factors at play that could not only cause the Fed to pause but to actually begin to cut rates again by late 2019 or early 2020. We will discuss these events later in this newsletter. This chart represents the difference in basis points between the 2-year treasury and the 10-year treasury bond. We began the year at around 60bps and reached almost 80bps before we began a very quick and steady move lower hitting 11bps in December. Historically, an inverted yield curve has been a perfect prognosticator of an imminent recession. Clearly we are moving very quickly toward a possible inversion and we would not be surprised if the curve inverts in the 1st quarter of 2019.

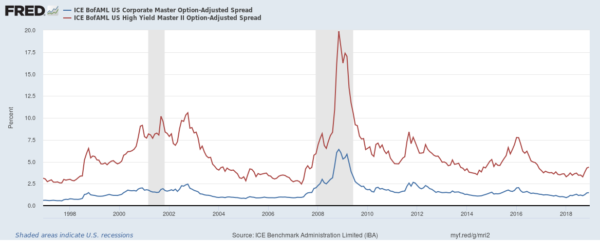

This chart represents the difference in basis points between the 2-year treasury and the 10-year treasury bond. We began the year at around 60bps and reached almost 80bps before we began a very quick and steady move lower hitting 11bps in December. Historically, an inverted yield curve has been a perfect prognosticator of an imminent recession. Clearly we are moving very quickly toward a possible inversion and we would not be surprised if the curve inverts in the 1st quarter of 2019. For most of 2018 this spread stayed relatively steady and actually ground to a historically low spread of 209 basis points in September. This means investors were receiving a mere 2.09% for taking the risk in HY bonds vs. IG bonds. By December this spread had widened to over 300bps an increase of almost 100bps or 1%. This spread has historically been between 500 and 600 basis points or an additional 5% to 6% for purchasing HY bonds over IG bonds. While this 1% move is painful for HY investors (as the spread widens the price of the bond falls) it is nothing compared to the pain we will see if HY spreads move to historical average levels or beyond. In our October newsletter we discussed credit spreads in some detail and offered an illustration as to what this spread widening means in actual dollar terms for investors. The takeaway from that analysis was that if credit spreads moved to the lower end of historical average at 500 basis points, an investor with $1 million in bonds would see a price decline of approximately $67,000 on a portfolio of IG bonds vs. a loss of $280,000 on a portfolio of HY bonds. However, that is if we simply move back to average spreads and during times of stress spreads almost always move far wider than the historical average.

For most of 2018 this spread stayed relatively steady and actually ground to a historically low spread of 209 basis points in September. This means investors were receiving a mere 2.09% for taking the risk in HY bonds vs. IG bonds. By December this spread had widened to over 300bps an increase of almost 100bps or 1%. This spread has historically been between 500 and 600 basis points or an additional 5% to 6% for purchasing HY bonds over IG bonds. While this 1% move is painful for HY investors (as the spread widens the price of the bond falls) it is nothing compared to the pain we will see if HY spreads move to historical average levels or beyond. In our October newsletter we discussed credit spreads in some detail and offered an illustration as to what this spread widening means in actual dollar terms for investors. The takeaway from that analysis was that if credit spreads moved to the lower end of historical average at 500 basis points, an investor with $1 million in bonds would see a price decline of approximately $67,000 on a portfolio of IG bonds vs. a loss of $280,000 on a portfolio of HY bonds. However, that is if we simply move back to average spreads and during times of stress spreads almost always move far wider than the historical average.