Stencil Financial

28734 Rain Creek Road

Hanover, MI 81129

851.357.2257

dan@stencil.com

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

What Makes Up Gasoline Prices – Commodity Review

The dramatic decrease in crude oil prices has led to a shift as to how gasoline is priced. Various components determine the price of gasoline, including the cost of distribution, taxes, refining, and crude oil.

These various components tend to vary in the make up of gasoline prices as conditions change and markets adjust.

Sporadic and infrequent occurrences such as a major storm can reduce gasoline supplies in parts of the country leading to short term price “spikes.” Refining and distribution facilities can also be affected or even close temporarily, creating severe shortages and delivery disruptions. Labor strikes and shortages can also cause production reductions and supply issues.

Regulations affect gasoline prices in some states more than others. California typically experiences some production shortages as refiners switch from summer to fall gasoline blends to adhere to state pollution reduction measures. Gasoline prices in California are typically higher than in most of the country due to stricter environmental regulations. Gasoline prices vary from state to state depending on individual state regulations and environmental standards. The cost of refining is higher in such states as California due to required blends in order to qualify for environmental standards.

The average cost for refining nationwide makes up about 1% of a gallon of gas, excise taxes make up 17%, distribution & marketing 25%, and the raw material cost of crude oil, make up roughly 56%.

Source: U.S. Energy Information Administration

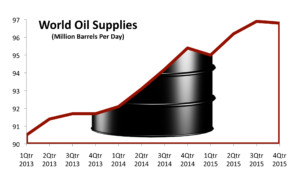

OPEC Pumps Up Oil Production – Oil Industry Update

As oil prices rebounded throughout May and June, drillers restarted idle rigs in hopes of catching higher prices as they evolved. Unfortunately, the upswing in production and drilling was accompanied by growing supplies and less consumption, thus resulting in a supply glut.

As a group, OPEC represents the world’s largest producer of oil, with Saudi Arabia being the single largest producer at over 10 million barrels per day, roughly a third of total OPEC production.

The dramatic decline in prices in July alone are a testament to the commodity’s volatility, subject to supply and demand dynamics worldwide. Yet even with such an efficient market, as claimed by Saudi Arabia, producers tend to get it wrong as to what the actual demand might be. Some oil analysts believe that OPEC leaders, specifically Saudi Arabia, may have increased production knowing that additional demand was not yet there.

Crude oil prices traded as high as $107 per barrel as recently as June 2014, and now pulling back to near $40 as of the end of July.

Sources: OPEC Monthly Production Report, OPEC Secretariat

hrhrrh

Delinquencies On Credit Cards & Auto Loans Rise – Consumer Credit

A consistent low interest rate environment over the past eight years has made it easy for American consumers to purchase expensive automobiles and to borrow on credit. Consequently, the amount of outstanding auto loans and credit card balances has escalated over the same period. Increasing delinquencies have become a concerning trend as numerous consumers are past due on auto and credit card payments 90 days and more.

Auto loan delinquencies are at the highest levels in nearly 15 years, a result of what is believed to be looser lending standards. Not only that, but consumers are carrying loans for longer terms, with the average new car loan at 69 months. In April of 2013, the average new car loan was for 65 months.

A rising interest rate environment is also posing a challenge for new automobile buyers and consumers taking out credit. Higher rates raise monthly loan payments thus making it that much more challenging for consumers on an already tight budget.

Source: Federal Reserve Bank of New York