Stencil Financial

28734 Rain Creek Road

Hanover, MI 81129

851.357.2257

dan@stencil.com

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

hsnsnsgsts

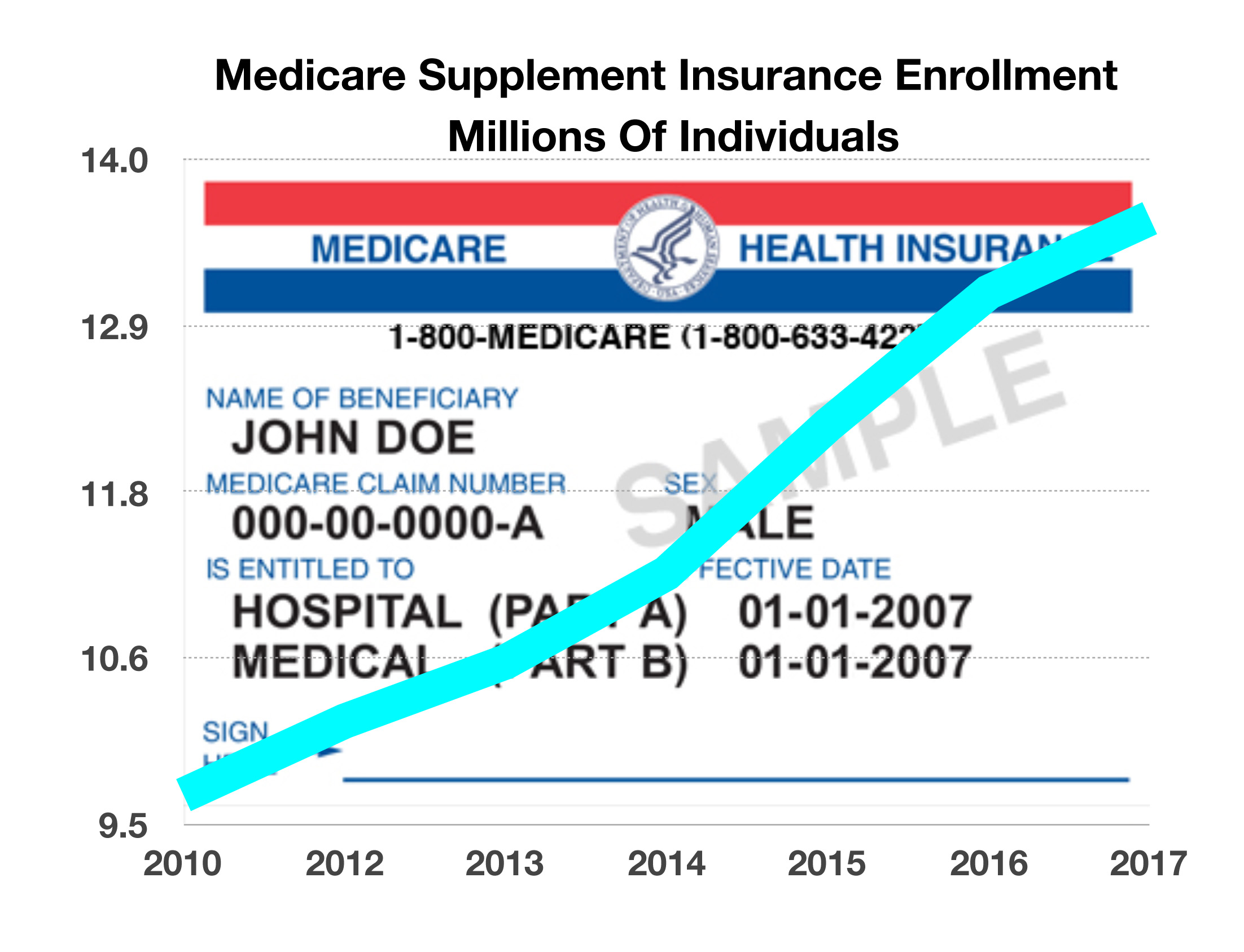

Medicare Supplemental Insurance Purchase On The Rise – Healthcare Overview

Supplemental insurance coverage that pays for medical expenses not covered by Medicare is on the rise. Over 500,000 new supplemental policies were purchased in 2017, with over 13.6 million retirees carrying supplemental insurance coverage as of December 2017. Over the past ten years, the number of retirees with supplemental coverage increased 40%, driven by demographics and cuts in Medicare covered services.

Retirees can optionally enroll in private individual insurance policies that supplement original Medicare. These plans are standardized and identified by plan letter (Plans A-N). Also called Medicare Supplemental Insurance, retirees have the ability to choose their doctors, specialists, and care facilities.

Sources: Congressional Research Service, American Association for Medicare Supplement Insurance