Bruce Harrison

HCO Private Wealth

2008 Stephenson Ave.

Roanoke, VA 24014

540.204.9310

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

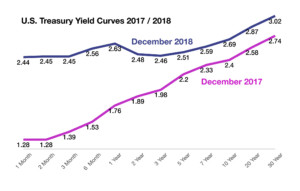

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

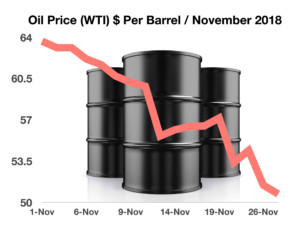

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Restructure 401K Business Goal: ? Implement a new 401K client model that only has us working with plans where we manage assets ? directly. No longer handle plans with outside assets and plans must net a minimum of $5K per year. ? Convert existing plans to this model.? Impact Filter Review/Discussion:? * How do we figure the cost of forcing existing accounts to convert? ? o How many existing 401K accounts are there? ? o Can we figure / do we know the existing cost of keeping these? ? ? Range of $$ we earn annually currently?? ? is there an average we can use?? ? are we losing $$ on any of them?? o Are these accounts on their own contract timeline? ? o What’s the current plan setup? Any minimum net?? ? Need to determine what it means money-wise to change it * Worth time/effort and possible alienation?? o Ethically ok to say “your place of employment uses us so you have to also?”? o Are there any plans where we already have doc assets?? ? If so are we making them convert or do we allow them to be “grandfathered” ? * Is there a possibility of losing current business if we rock the boat ? with the administrator/other docs?? * Is there a way to somehow quantify what “significant service hassles, revenue collection ? issues and outside time it takes to service” means?? * E&E o What’s the extent of his involvement / current deal with him?? o Do we have to have his blessing on the conversion plans or just his buy in on this ? restructure moving forward? ? o What’s the possibility that something like Launch401K appeases him? ? ? Are there other programs like that?? * Timeline o Do we have any prospects of 401K plans coming up?? o What’s the usual lead time when those do pop up?? o Mention was made on some kind of reworking that has already been done (maybe ? for Albemarle??)? ? Is that a plan we can take forward or was that a one off?? * One criteria was “We position with our clients that we cannot accept implied fiduciary liability ? on non-HCO outside accounts.” ? o Is this just in case we decide not to do this project for current plans? Or is it needed ? regardless? It seems like if we move ahead and force current plans to adopt the new ? structure then this isn’t a needed outcome???