Voter Turnout Statistics – Domestic Demographics

During the 2012 Presidential Election, as in previous elections, voter turnout was closely followed. This year’s election may have similar characteristics as other elections, making who turns out to vote once again important. A few key factors affect voter turnout, including education, income, and age.

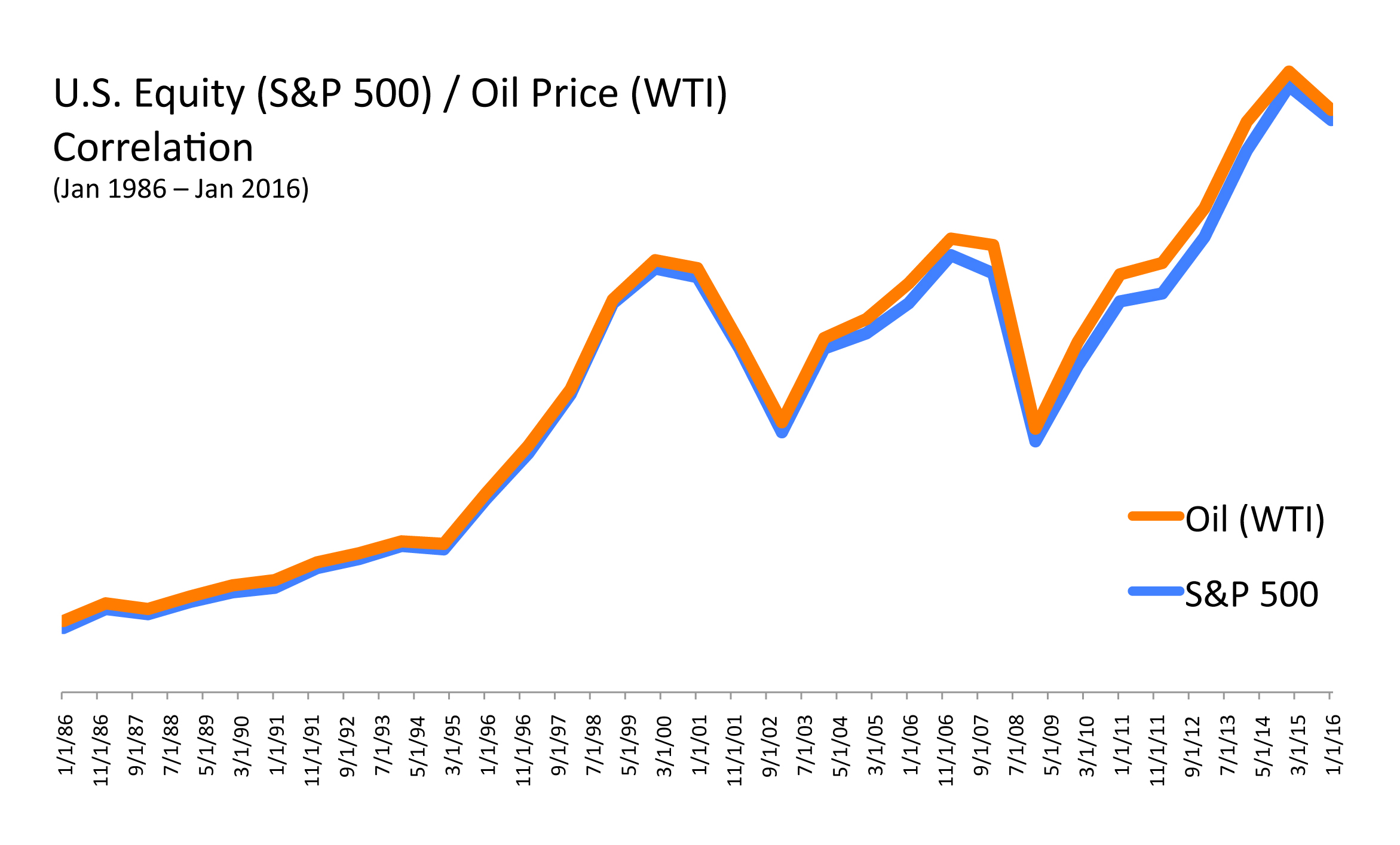

Income disparity has become more of a discussion among politicians. In the 2012 election, individuals with a higher level of education tended to vote more than those voters with lower incomes.

Voter turnout is determined by the number of eligible voters who cast a ballot during an election. Some voters are individuals while others are members of larger families, thus creating social economic dynamics. Social economic factors significantly affect whether or not individuals and family members develop a discipline of voting in future elections.

It is suggested that the most important social economic factor affecting voter turnout is education. That is the more educated an individual is, the higher the probability that he or she will vote during any given election. Hence, it’s no surprise that all political parties strongly support a strong educational base in this country.

Sources: U.S. Census Bureau, Bipartisan Policy Center