Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

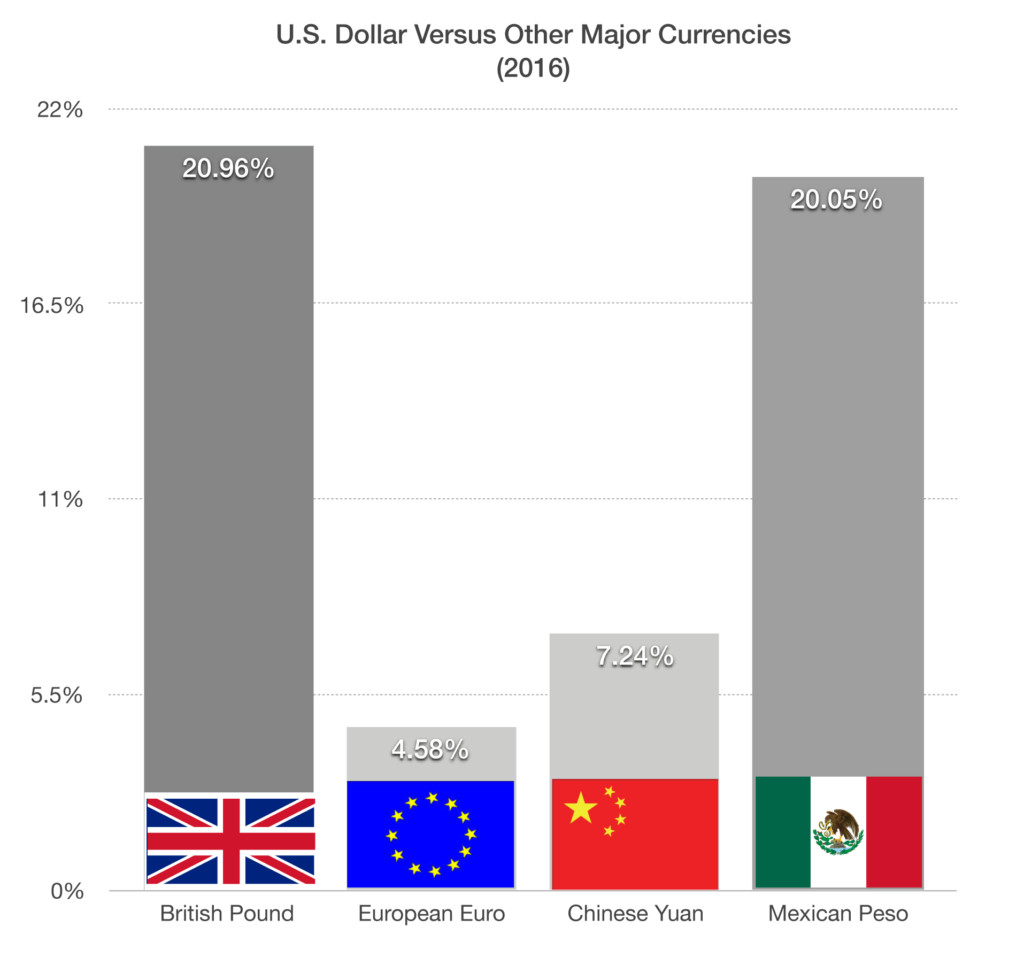

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

January Themes

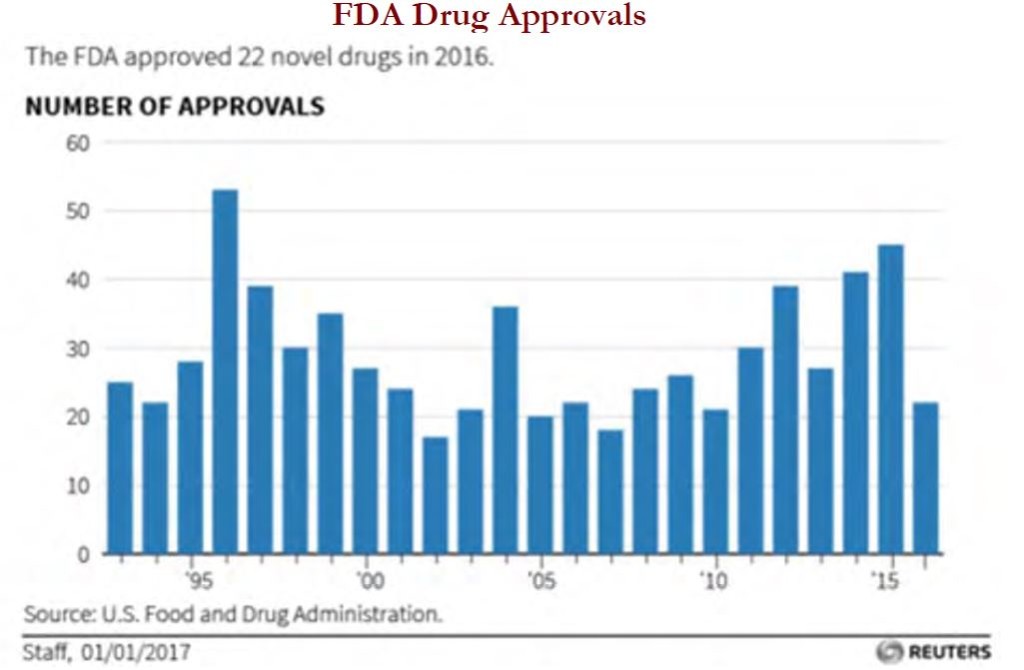

The new year begins with a couple themes which started to surface in late December. The first theme is a return to outperformance by three groups, which had a rough H2, 2016. Biotech, sovereign bonds and precious metals miners suffered from a combination of regulatory uncertainty (health care & biotechs), fears of inflation-faster growth (bonds) and a strong Dollar/higher rates (precious metals). All three themes saw accelerated selling in to year-end, but now tax related selling should be behind these names and with portfolio positioning more favorable, sharp bounces in each sector would not su

An overhaul of the Affordable Care Act may be the spark which ignites the broader health sector. Biotechs have traded sideways for many months and on a longer term perspective are off 33% since the Q2, 2015 high. You don’t find many major equity sectors with a track record like that. Long-term sovereign bond yields have been rising across the world, but one of the anomalies has been the German 2-year yields which is near historic lows and are soundly negative at -81 bps. Short-term German rates fell which the rest of the yield curve rose, a development which suggests the Kondratieff Winter remains alive in Europe and potentially subject to more monetary stimulus from the ECB. This would surprise the markets and likely lead to a lower Euro. It would also put further wind at the back of European stocks, which are one of my votes for a potential upside surprise in 2017, at least early in the year. The risk of a French election upset remains, but I am starting to think it is in Germany where the pivot point lies and if the security situation does not improve there, Chancellor Merkel is a short. Will she resign before the elections?

Back to sovereign bonds. I am not saying the sell-off in government bonds, which is the major trend, has changed. I am saying that in Europe and the U.S., it may have run a little ahead of itself, so a rally in debt markets would not surprise. On the U.S. 10-year, a retreat to 2.20% would be where sellers should show up again. Economic data in the U.S. is very strong in some areas, i.e. small business hiring, but other indicators are close to levels, which have presaged past recessions. Stay tuned, the U.S. economy is near an inflection point with deregulation and tax cuts coming and a time lag to both, something markets will have to deal with. Are investor expectations for U.S. stocks too aggressive now?

Finally the precious metals names started their second leg in a bull market, during the last week of December. Even a modest bond rally and a Dollar which moves sideways, should be enough to launch these stocks. As inflation pressures build, should economies accelerate, or bonds rally should an economic miss occur, the precious metals seem to be in a good location. Some names corrected 50%-61% from their highs of mid-August, so for Fibonacci fans, the numbers are there.

1990, 1994, 2002, 2011 and 2015. So when stocks start strong, they end strong.

1990, 1994, 2002, 2011 and 2015. So when stocks start strong, they end strong. IS.

IS. Trump administration officials.

Trump administration officials.