Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

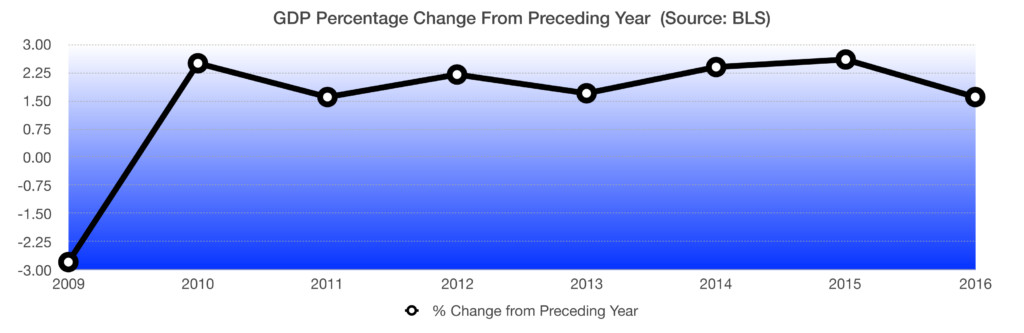

Why GDP Growth Was Lackluster For 8 Years – Domestic Economy

A key component of GDP growth has been lagging for years, as a lack of incentives for companies to invest in capital has been an issue.

Many believe that economic growth since the financial crisis in 2008/2009 has been driven primarily by the monetary stimulus efforts enacted by the Federal Reserve. The Quantitative Easing programs, aka Q.E. 1 & Q.E. 2, provided tremendous liquidity for nearly eight years as the Fed bought debt and placed it on its balance sheet.

The problem is that what the Fed did was considered a form of “artificial stimulus”. Rather than investing in capital equipment for long-term economic growth, companies instead borrowed money at historically low rates via issuing debt, then bought back a portion of their stock. This in turn helped send stock prices higher without any tangible economic growth strategy in place. As this transpired, GDP growth lagged and companies basically became complacent with anemic rates of growth.

The U.S. Small-Business Optimism Index is a leading economic indicator for GDP growth. Recently this index jumped to its highest reading since 2002. Small companies represent 99% of all U.S. employers and they believe now is a good time to expand, increase capital expenditures, and keep hiring. Small business owners are feeling better about taking risks and making investments which will drive GDP growth higher.

Source: BLS